Expo City expands on the legacy of Expo 2020 Dubai by continuing its vision of a sustainable future that exists in harmony with nature.

Expo City expands on the legacy of Expo 2020 Dubai by continuing its vision of a sustainable future that exists in harmony with nature.

The urgency of addressing climate change has never been more pressing, with the built environment emerging as a pivotal battleground for reducing emissions.

In the UAE, where visionary leadership is driving ambitious net zero targets for 2050 under the Paris Agreement, the imperative to transform the construction sector is clear.

A report released last month at the Sustainability Cities in Action Forum 2024 at Expo City Dubai, titled UAE Sustainability Built Environment Blueprint, underscores the pivotal role of the built environment in achieving these targets.

An earlier report submitted in 2023 to United Nations Framework Convention on Climate Change states that the building sector was responsible for 27 per cent of greenhouse gas emissions in the UAE as of 2019. It will, however, deliver 81.4 per cent of the total emissions reduction targeted by the UAE for 2030.

The new report by the Developers’ Leaders Group – formed by the Emirates Green Building Council (EmiratesGBC) and the UN Climate Change High-Level Champion, COP28 – highlights that the built environment represents a substantial opportunity for emissions reduction, with a potential decrease of 56 per cent by 2030.

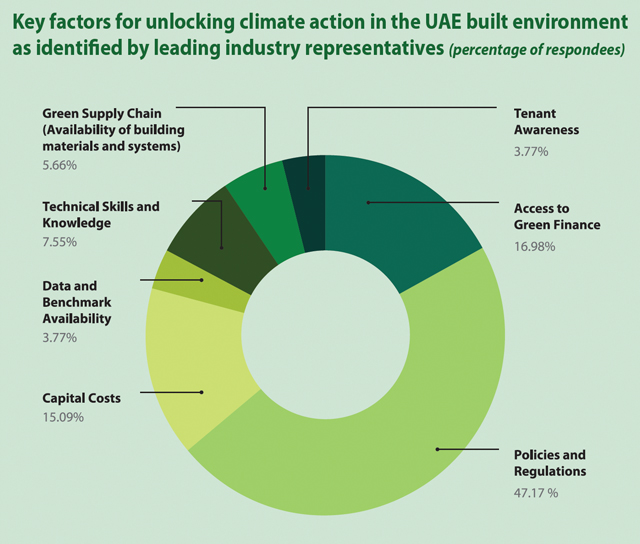

Through extensive consultations with more than 75 representatives from the industry, the group has outlined critical interventions across various domains, including policies and regulations, building materials and systems, finance, data, and skills.

Below are the key recommendations of the report under each of the domains:

1. Policies and Regulations: Setting the Foundation for Sustainable Development

Building codes

While the UAE boasts federal and emirate-specific green building codes, leading developers have embraced initiatives surpassing these standards. This proactive approach has not only driven market upskilling but also enhanced sustainability performance. Key interventions in this realm include refining building codes, bolstering energy-related policies, and strengthening building performance requirements.

|

|

|

The survey revealed that 75 per cent of respondents believed the most important policy enabler consisted of updating building codes to reflect greater market readiness and 73 per cent highlighted the need for greater standardisation of building codes between the different emirates.

• Update of local building standards: While the UAE has seen significant steps in introducing mandatory sustainability requirements into the local building market over the past 14 years with Estidama, Saafat (Dubai Green Building Regulations) and Barjeel, local codes remain based on older international standards such as Ashrae 2007 and 2009.

As such, there is a key opportunity to enhance mandatory building code requirements to reference updated standards and reflect market readiness, focusing on a tiered approach that includes more ambitious requirements for voluntary rating. The Air-Conditioning, Heating and Refrigerant Institute (AHRI) estimates that this could yield up to 45 per cent increased efficiency in mechanical, electrical and plumbing building systems.

• Harmonisation of national and local building codes: At the moment, the various local building codes present differing specifications and varying coverage of building systems. This includes differences in specifications of envelope performance, air-conditioning and cooling equipment, in terms of green materials. While some building codes include materials, envelopes, systems and waste, others focus primarily on envelope and building systems.

There is an opportunity to set unified building codes with minimum performance requirements at a national level.

Energy Policy

Supporting policies for distributed energy were highlighted by 56 per cent of the survey respondents as a key enabler required to transition the sector. Recommendations included:

• Enhanced regulations for decentralised renewable energy: All developers highlighted the current limitations relating to decentralised renewable energy whereby certain emirates don’t have specific regulations incentivising roof-mounted or built-in solar power, while others, such as Dubai, do have such programmes (Shams Programme) but have defined limits to the maximum capacity that can be installed.

|

|

|

There is an opportunity to introduce policy which further supports and incentivises the installation of decentralised renewable energy at a national level. This will be further enhanced by the existing plans to introduce supporting regulations for gross and net metering as noted in the Third Update of the Second Nationally Determined Contributions (NDC), the report says.

Industry consultants also highlighted sub-metering and wheeling as enablers to increase the share of decentralised renewable energy, which would also strengthen the regulatory environment for distributed solar power.

• Access to local renewable energy certificate and power purchasing agreements: A second challenge identified related to decentralised renewable energy and the current inability to buy local renewable energy certificates or power purchasing agreements.

Renewable technologies, including solar photovoltaic (PV), wind, and waste-to-energy, are economically viable in the UAE, competing with gas at low prices. This supports an accelerated shift to renewables, surpassing current targets, making a 25 per cent renewable power share by 2030 more cost effective.

Enabling access to local renewable energy certificates or power purchasing agreements would lead to an upscaled and diversified local energy market, which would allow greater investment from the private sector into the transition of the electricity supply, the report says.

Building Performance Requirements

Finally, 62 per cent of the respondents to the industry survey highlighted regulation relating to the retrofitting and performance of existing buildings as a critical enabler required to support the net zero transition.

• Minimum requirements for retrofits: While there are local targets for building retrofits in the emirates of Abu Dhabi, Dubai and Ras Al Khaimah, the incentives and regulations encouraging retrofits differ from one emirate to another.

There is, therefore, an opportunity to establish nationwide building retrofitting requirements and guidelines supported by local incentives, taking into consideration a building-by-building baseline approach, ensuring maximised energy efficiency, highlights the report.

Dubai Supreme Council of Energy has, for example, established a building retrofitting programme with the target of retrofitting 30,000 buildings by 2030 and has to date retrofitted 8,000 buildings. Lessons learnt and efficiency improvements from these projects can support establishing a baseline to inform national retrofit targets and performance criteria.

EmiratesGBC has also issued the Green Building Retrofit Guidelines which provide an organised collection of economically viable methods that will equip existing building owners in the UAE with the necessary tools to achieve sustainable and comfortable buildings. The guidelines help develop technical capacities and skills among industry professionals, building owners, operators and end users.

To address this, there are several opportunities that can be implemented at a regulatory level. These include:

- Establishing performance-monitoring requirements and incentives and linking them to rental index, registration fees and mortgage where banks do not support mortgage unless energy performance is being monitored.

- Introducing tools such as energy performance certificates that can be included in rental contracts or as part of the asset annual review, along with Display Energy Certificates (DECs).

- Developing infrastructure for examining the retrofitting performance of buildings. Energy service companies (ESCOs) can play a huge role by taking part in the framework that should involve auditing, monitoring and reporting of building retrofit plans.

- Enacting monitoring and regulatory protocols to oversee carbon emissions originating from buildings and equipment by utilising internationally recognised carbon emissions measuring standards for buildings and equipment to measure both embedded and operational carbon.

- Introducing equipment certification programmes to ensure that equipment and materials sold are market compliant.

2. Building Materials and Systems: Pioneering Green Innovation

Industry consultations reveal a growing trend among developers to establish internal green material specifications and system performance criteria. This shift underscores the commercial viability of greener alternatives compared to conventional practices. To further advance this agenda, targeted interventions in materials specifications, building operations, and energy systems are deemed essential.

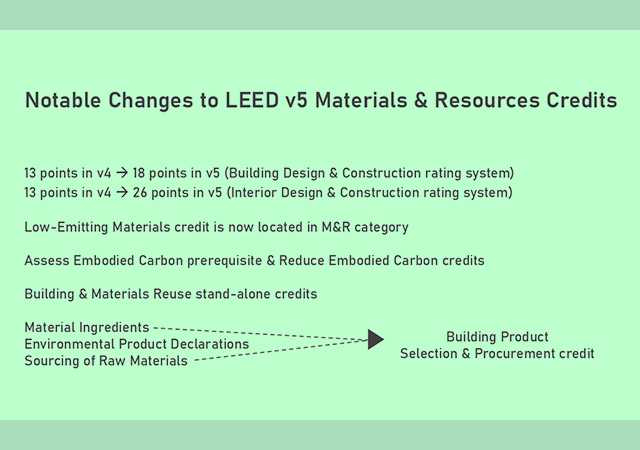

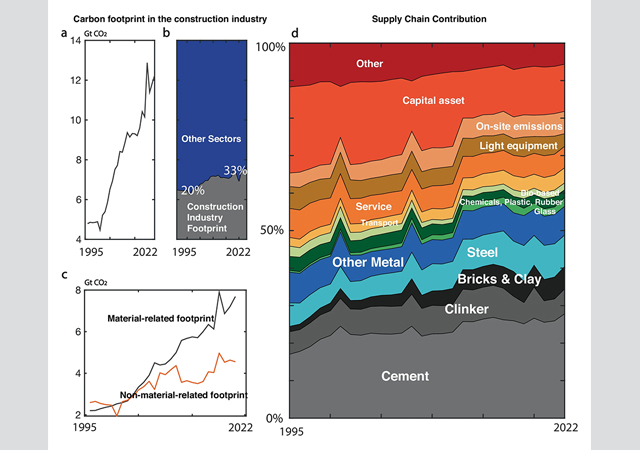

When discussing building materials and systems, there are two key aspects to consider: operational emissions to power and cool and heat buildings (28 per cent of energy-related global emissions) as well as embodied carbon emissions (11 per cent of energy-related global emissions). Environmental Product Declarations (EPDs) are the materials’ “nutrition label”, which show their impact on the environment.

At a local level, while the Dubai Municipality Manual of Green Building Materials and Testing Facilities does not directly share building materials’ EPDs, there is a sizeable library of green materials and their local suppliers, revealing the readiness of the local building market to adopt these materials and use them.

Industry consultations as part of this effort also revealed that several developers have established internal green material specifications and system performance criteria that are then implemented across their project portfolio, further confirming commercial availability of greener and better performing materials and systems compared to existing building codes and business-as-usual practice.

The report explores three main enablers related to building materials and systems, which include materials and systems specifications, building operations and the power factor.

In addition to updating building codes to reflect commercially available green materials and building systems, it is important to develop publicly available benchmarks of the performance of existing buildings and systems to ensure that designers and developers adjust their specifications accordingly and avoid overdesign, especially with regard to cooling, electricity and water demand, the report cites.

This includes the need to correct the power factor. Often, the power factor is less than 0.9 and it hence does not measure power consumption correctly. The power factor can be increased to 1, resulting in a more optimal use of the power supplied to the building, it says.

There is also an opportunity to create a market shift through a demand-led approach, whereby both public and private sector developers adopt internal specifications beyond business as usual.

Another enabler identified was to establish a database of green materials or apply labelling schemes such as Environmental Product Declarations (EPDs). This could be undertaken by non-government organisations with the support of the private sector or could be an effort undertaken by a government. Previous successful examples of similar efforts include Masdar’s Future Build portal and the Estidama Villa Product database by the Estidama Programme.

Related to building systems, there is also the need to ensure optimal building operations and preventive maintenance. ESCOs and Super ESCOs can act as third-party verifiers to ensure optimal building operations. Facilities management companies can also provide similar services provided that they have the in-house capabilities.

3. Finance: Unlocking Investment for Sustainable Development

Access to green finance remains a significant hurdle, with complexities in qualifying criteria and application processes deterring investment. Addressing these challenges requires the establishment of green finance standards, improved data transparency, and streamlined application procedures, the report points out.

The key concept behind green finance is to create a sustainable and resilient economy that can address climate change challenges and promote the transition to a low-carbon economy.

Green finance encompasses green mortgages, green loans, green credit cards, green banks, and green bonds. Globally, the Green Loan Principles (GLP) have been developed by an experienced group of representatives from leading financial institutions active in the green loan market, to promote the development and integrity of the green loan product.

In 2021, HSBC was the first bank in the UAE to issue green finance to customers looking into purchasing homes that are sustainable within standards set by the bank. Of the local banks in the UAE, First Abu Dhabi Bank and Ras Al Khaimah Bank also issue green mortgages.

Towards the end of 2022, six UAE banks collectively channelled AED190 billion ($51.8 billion) into green financing initiatives, as reported by members of the UAE Banks Federation (UBF).

The increased interest in and availability of green finance by the banking sector presents an opportunity for the building sector to access wider options for financing. To do so, developers would have to work on decarbonising their asset portfolio and delivering more sustainable buildings.

However, around 60 per cent stakeholders, have identified the lack of green finance as the biggest challenge to accessing funds, while 47 per cent and 49 per cent have, respectively, highlighted that the criteria to qualify for green finance are too complex or the application process is not clear. Following the engagement sessions that took place as part of the development of the report, the key factors identified to enhance the availability of green finance for the building sector include: green finance standards, green finance data, and risk return.

• Green finance standards: Following feedback from a dedicated workshop with the finance sector, one of the main challenges identified was a lack of common standards for sustainable buildings. Having endorsement by the federal government of defined standards for green buildings will further provide reassurance and a common standard for financial institutions against which they can provide green finance options.

• Green finance data: One of the challenges highlighted by banks with regard to providing green finance included the availability of historical data that can help assess the impact of green finance and will, therefore, encourage banks to provide loans against set performance criteria that are either expected or conditional on the finance granted.

• Risk return: Finally, risk return was identified as another area hindering greater availability of green finance in the market. Sustainable buildings are sometimes more expensive and green loans are not necessarily cheaper. There is today a challenge in monetising sustainable performance and this also applies to building retrofits, which are risky and complex in nature.

In addition to having better quality benchmarking data on the performance of sustainable buildings, as mentioned earlier, regulators can also play an active role. Federal government can help develop a building energy performance or efficiency registry to better help banks factor in climate risk across the building and construction sector. This will, in turn, help banks develop a more climate risk-informed, risk-weighted asset register and properly allocate credit in line with a net-zero transitioning client base, the report notes.

As the built environment sector is traditionally identified as a hard-to-abate and harder-to-transition sector, the credit risk associated with these sectors can be higher. Federal government can also support liquidity of green finance by lowering the cost of lending, based on defined sustainability performance criteria, it says.

4. Data: Empowering Informed Decision-Making

Robust and accessible data play a pivotal role in facilitating green transformation within the built environment. Collaboration between organisations like the EmiratesGBC and governmental entities is crucial in ensuring the availability and accessibility of comprehensive data, thereby empowering stakeholders to make informed decisions.

Data on green buildings in the UAE is available with the respective local authorities overseeing the permitting and verification of buildings including the Department of Municipalities and Transport in Abu Dhabi for Estidama, Dubai Municipality for Saafat and Ras Al Khaimah Municipality for Barjeel Green Building System. This also applies to building retrofits, with Dubai holding the largest number of buildings retrofitted within an emirate, and Dubai Supreme Council of Energy being the entity overseeing it.

Organisations such as the EmiratesGBC work with governmental entities and municipalities to make the data easily accessible to the public and readily available to stakeholders to aid in raising awareness of and promoting green building practices. In efforts to bring data to the forefront, EmiratesGBC has issued several sequels of the UAE Market Brief report. It has also worked on benchmarking the energy and water status of different building typologies in the UAE, in 2016 and 2019, through its Benchmarking Report.

There is one main pain point in understanding issues related to data – performance data.

Data availability presents a challenge on multiple fronts including specifying improved building materials and systems, and unlocking green finance. Stakeholders also highlighted the lack of data on the trade-off between embodied carbon and energy efficiency.

In order to address this, there is an opportunity to perform benchmarking for building performance per building typology. This is an area on which EmiratesGBC is currently working, and is in the process of developing benchmarking for select building typologies. Moreover, there is an opportunity to work with local authorities (such as the power supply entities as well as the regulators providing the permits) to share the existing performance evaluation of new buildings as well as retrofit projects. Utility providers could provide energy information and the energy utilisation index of buildings, similar to Dubai Electricity and Water Authority’s (Dewa) current practice of providing benchmarking to users of their consumption patterns compared to those of peers, the report says.

Energy efficiency certificates can also be applied, whether on a voluntary or mandatory basis, through the relevant electricity or land authorities. In turn, the energy efficiency certificates can be linked to green finance options or other incentives.

5. Skills: Building Capacity for Climate Resilience

As companies prioritise climate action, there is a growing need to upskill the workforce to navigate the complexities of green building practices. Enhancing skills in reporting, decarbonisation strategies, and building operations management is vital to driving sustainable development in the UAE.

Companies in the UAE are moving towards stronger action on climate issues. But to move faster and further, there is a need to upskill the workforce. The concept of green buildings is not new, however, the technicalities of the movement are.

Locating experts in net zero accounting or risk management is a challenging task, and this scarcity isn’t limited to the Middle East; on a worldwide scale, over three-quarters of financial professionals express a shortage of sustainability-related skills. In addition to reporting, the industry stakeholder engagement highlighted skills for building maintenance as well as lack of guidance on decarbonisation pathways as two areas requiring additional support in order to deliver on the transition to a net zero and resilient building sector.

In conclusion, achieving the UAE’s net zero climate targets requires a coordinated effort to harmonise green building policies and market enablers. The Developers’ Leaders Group stands poised to support the Ministry of Energy and Infrastructure in spearheading these initiatives, fostering a transition towards a sustainable built environment aligned with the nation’s ambitious climate objectives, the report says.

.jpg)

(1).jpg)