Two future-focused plans – highly ambitious in nature – were launched last month confirming that the emirate remains undaunted by the Covid-19 pandemic, the low oil prices and the general gloom pervading the global arena. Launched in the year the UAE marks the 50th anniversary of its founding, the Dubai 2040 Urban Master Plan and the UAE’s Industrial Strategy “Operation 300bn” have been well charted out to prepare for the challenges of the future.

The urban masterplan lays out a strategy for the next two decades, which involves creating two new urban centres – the Expo 2020 district, which will become the epicentre for exhibitions, tourism and logistics sectors, and the Dubai Silicon Oasis, which will emerge as a science and technology and knowledge hub. This apart, three existing urban centres – namely, the historic Deira and Bur Dubai areas, the business and financial districts of Downtown and Business Bay, and the hospitality and leisure areas of Dubai Marina and JBR – will be revitalised (see Page 28).

The Industrial Strategy “Operation 300bn” outlines the UAE’s ambitions to transform itself into a manufacturing hub, kick-starting an “industrial revolution” to empower and expand the sector to become the driving force of a sustainable national economy, more than doubling its contribution to the GDP from the current AED133 billion to AED300 billion ($36.2 billion to $81.66 billion) by 2031, according to a Wam news agency report.

|

|

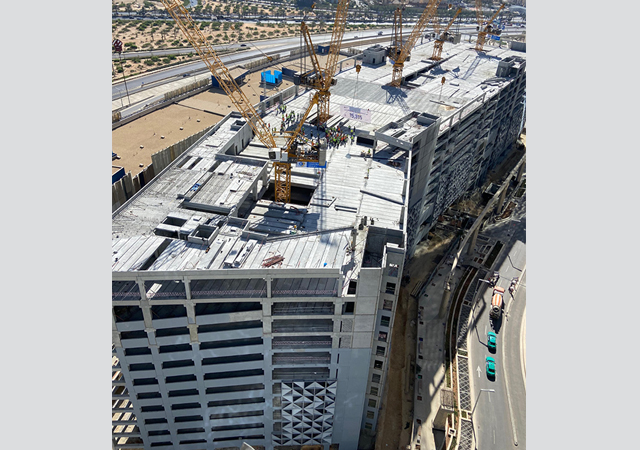

All efforts are now concentrated on ensuring a successful Expo 2020 Dubai. |

Dubai has demonstrated its “can do” approach over the decades; and these two plans should hold it in good stead despite the property glut the emirate faces, which have driven prices down by more than a third since the market peaked some seven years ago. Many in the real estate sector are now cautious in launching new developments and even Dubai’s largest developer Emaar has temporarily halted new projects, in a bid to cut its losses against the property gloom.

“We as a group have stopped supply,” stated CEO Mohamed Alabbar in December last year, while speaking at a UAE-Israel conference in Dubai, adding that demand was improving but the market remained oversupplied.

Among the landmark projects that will be hit by this announcement is the Dubai Creek Harbour Tower, billed to be higher than Burj Khalifa, which is now the world’s tallest building.

Another major company that has suffered the brunt of the coronavirus pandemic is Arabtec Holding, a UAE-based contractor for social and economic infrastructure, which has recently filed for liquidation “due to its untenable financial position”.

|

|

Under the Urban Masterplan, nature reserves and rural natural areas will constitute 60 per cent of the emirate’s total area. |

However, with the countdown now on for the Expo 2020 Dubai – scheduled to open its doors to the world on October 1 for a six-month-long festival – developers with projects in progress are now racing to complete them in time for the influx of visitors and potential investors.

The 4.38-sq-km Expo 2020 site located within the Dubai South district, close to Maktoum International Airport, is a hive of activity, with work now focused on landscaping and fit-out works on the Expo-owned buildings, most of which were completed at the end of 2019. This apart, the more than 200 countries participating in the world-class event are working on constructing and completing their pavilions (see Page 42).

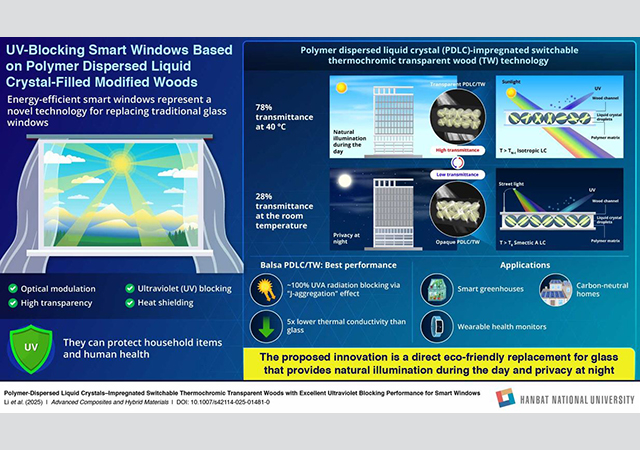

Power & Water

The expo centre is expected to be powered by the mega Mohammed bin Rashid Al Maktoum Solar Park, which is currently being developed in the emirate. On completion, it will become the largest single-site solar park in the world, based on an independent power producer (IPP) model with a planned capacity of 5,000 MW in 2030 involving a total investment of AED50 billion. The total capacity of currently operational projects at the solar park is 1,013 MW.

Over the past year, work has been launched on the fifth phase of the solar park, which comprises a 900-MW solar photovoltaic (PV) plant being built at a capital cost of $564 million. Acwa Power, a Saudi-based developer, investor and operator of power generation and desalinated water plants, has closed all financing agreements for the fifth phase. In July 2020, Acwa Power appointed Shanghai Electric as the engineering, procurement and construction (EPC) contractor for this phase. The plant is said to be the first utility scale solar PV power facility to operate remotely with zero manpower on site, and is aimed to be delivered by Shanghai Electric in three phases, with a construction period of 12 months on each 300 MWp phase.

Meanwhile, work is ongoing on the fourth phase which involves a 700 MW concentrating solar power (CSP) plant. The project will be the world’s largest CSP plant housing a 100-MW central tower plant, three 200-MW parabolic troughplants and 250 MW of PV capacity.

|

|

The Heart of Europe ... a $5-billion development. |

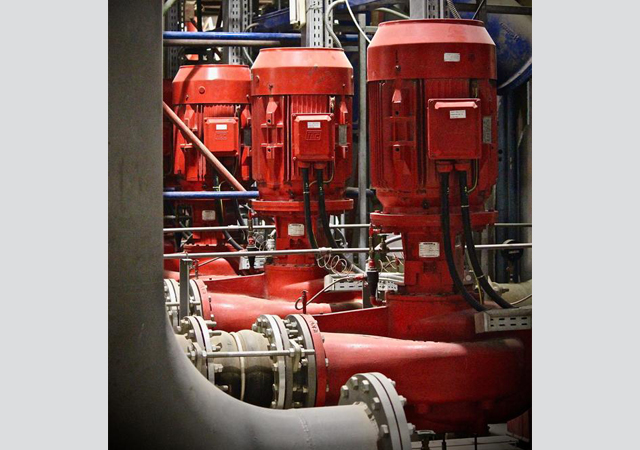

In the water sector, a landmark development is the Hassyan Sea Water Reverse Osmosis (SWRO) plant. The 120-million-gallons-per-day (MGD) facility is Dewa’s first independent water producer (IWP) project and is expected to commence production in 2024.

“The project is part of Dewa’s strategy to increase the water desalination capacity in Dubai to 750 MGD, from 470 MGD at present,” said Managing Director and CEO Saeed Mohammed Al Tayer. “We are building water production plants based on reverse osmosis which requires less energy than Multi-Stage Flash distillation (MSF) plants, making it a more sustainable choice for water desalination. By 2030, Dewa aims to produce 100 per cent of desalinated water by a mix of clean energy and waste heat.”

Utico, a leading full-service utility, is responsible for the construction and operation of the plant.

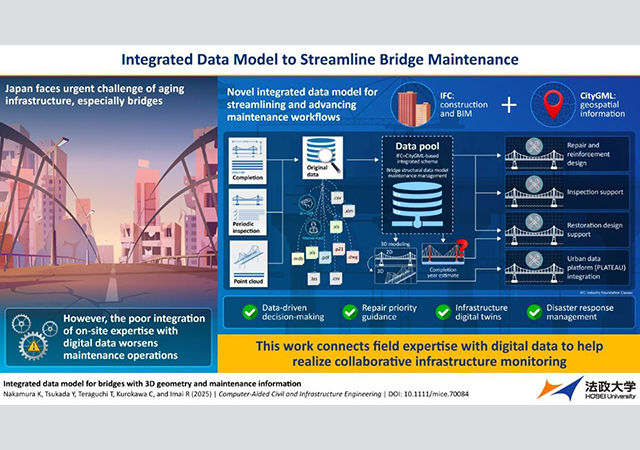

Roads

Dubai’s Roads and Transport Authority (RTA) has, over the past few years, undertaken a number of road projects in a bid to ensure smooth traffic in the emirate, especially in view of the upcoming Expo 2020 Dubai. More than Dh3 million has been invested in completing all phases of roads project leading to the Expo site.

|

|

Aykon City ... a Damac project. |

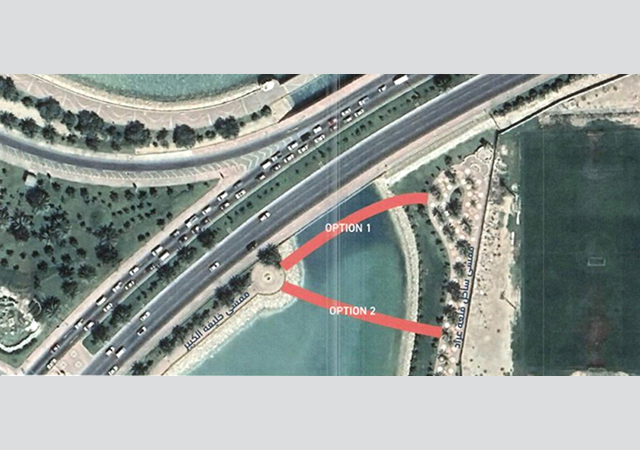

Meanwhile, one of the largest projects currently under way is the 13-km Shindagha Corridor Project, being developed by the RTA at an investment of Dh5 billion. Construction work for the project has been split into five phases that support several development projects in the area such as Deira Islands, Dubai Waterfront, Dubai Maritime City and Port Rashid. The first two phases have already been completed and included upgrading the junction of Sheikh Rashid-Oud Metha Streets (Wafi Junction), and the intersection of the Sheikh Rashid-Sheikh Khalifa bin Zayed Streets.

Work is currently under way on Phase Three of the project (see also Page 38).

Among other developments, Nakheel joined hands with the RTA to develop five bridges leading to Deira Islands. The bridges are a key part of the Al Shindagha Corridor.

The RTA is also spearheading the development of roads leading to the other UAE emirates. Work is progressing on the AED2-billion Dubai-Al Ain Road improvement project, which is now nearly 60 per cent complete.

Work is also 60 per cent complete on the Al Khawaneej Road Improvement Project, which is one of the strategic projects for improving the links between Dubai and Sharjah.

|

|

One at The Palm Jumeirah, Dorchester Collection ... an Omniyat project. |

Real Estate

Dubai’s property market is seeing a new trend with buyers opting for spacious homes in newer localities, according to leading real estate portal Property Finder. With the majority of the city’s residents having been housebound during the lockdown, the emirate has been experiencing a demand for larger homes. Developers are now catering to this trend by offering larger homes in more affordable areas.

Among the landmark real estate projects that have made significant progress despite the Covid-19 pandemic is The Heart of Europe, the $5-billion prime hospitality and second home destination amid The World islands in Dubai.

Leading developer Kleindienst Group has exerted efforts to ensure work continued on the development without major disruptions, even during the lockdowns given its remote location. The focus of development is now on its hotels, with the developer indicating that 15 innovative hotels and resorts are fast evolving at the develoment. They will bring more than 4,000 hospitality units, catering to regional and international tourists. Among the latest luxury property launched is Marbella Hotel, on Main Europe – largest of the destination’s six contrasting island. Upscale hospitality landmarks nearing completion at the development include Portofino, the region’s first family-dedicated hotel, and the Côte d’Azur resort.

Early this year, Kleindienst Group began handing over the first of the 2,000 residential and hospitality units within the development.

|

|

One Za’abeel ... an engineering marvel. |

Among the projects that have challenged the engineers is Ithra Dubai’s luxury development, One Za’abeel. Located adjacent to the Dubai World Trade Centre, it comprises three key components, namely Towers A and B and ‘The Link’, one of the longest cantilevered structures in the world, which bridges the towers at a height of 100 m. The contractor Alec Engineering and Contracting (Alec), recently marked the topping out of Tower B.

Ithra Dubai is also spearheading the Deira Enrichment Project, a massive mixed-use development meant to rejuvenate and revitalise Dubai’s heart of commerce and the oldest community. Phase One includes 50 mixed-use buildings, 2,200 residential units, 416 commercial units, 843 retail units, restaurants and cafes, as well as eight hotels with more than 1,450 rooms and serviced apartments, and multiple leisure facilities.

Other striking developments include The Residences, Dorchester Collection, Dubai and the One at Palm Jumeirah, Dorchester Collection, which are being developed by Omniyat. Managed by the hospitality brand, Dorchester Collection, the landmark developments are in the final stages of completion (see Page 32).

Another key Dubai Developer is Nakheel which has projects under way at Deira Islands. It is now poised to complete work on its landmark Palm Tower on its previous major island development Palm Jumeirah (see Page 34).

Other key projects:

Uptown Tower: DMCC, one of the world’s leading free zones, announced recently that its mixed-use development, Uptown Tower has reached 153 m, with over 32 floors completed. Uptown Tower, is being developed within Phase One of Uptown Dubai district (see Page 41).

Dubai Maritime City (DMC): Dubai-based global trade enabler DP World said nearly 80 per cent of the infrastructure works have been completed within Phase One of Dubai Maritime City (DMC), a mixed-use commercial district. Phase One infrastructure will integrate DMC with the Mina Rashid area.

Aykon City: Damac Properties is developing the 53-storey Aykon City on Sheikh Zayed Road, which offers spectacular views of the city skyline as well as the Dubai Canal. The developer recently announced the structural completion of Tower B fully completed. Other projects being developed by Damac include Zada tower and Damac Hills.

Riviera in Mohammed Bin Rashid City: Azizi Developments has recently announced the completion of 64 per cent of the construction of the first phase of Riviera in Mohammed Bin Rashid City. Phases two and three have reached 48 per cent and 26 per cent respectively. The Mediterranean-inspired waterfront-lifestyle destination, which is part of Meydan, is planned to comprise 16,000 residences.