Bhatia with his company’s products ... remarkable experience.

Bhatia with his company’s products ... remarkable experience.

CONARES, a leading UAE-based provider of downstream steel products in the region, will be at The Big 5 show next month to leverage the unprecedented growth and opportunities in the regional market.

“Conares has exhibited previously at The Big 5. It was a remarkable experience and we received an overwhelming response from potential customers and serious buyers from different parts of the world,” says Conares CEO Bharat Bhatia, who is a top-ranking Indian business leader in the UAE.

“We are very pleased to be part of The Big 5 once again. The wonderful exposure that our brand receives is extremely beneficial for us. Our participation is a continuous emphasis of our market presence with our current products and services. The exhibition will also help us in our plans to increase production capacity as well as verifying our products.”

Bhatia says Conares supports Dubai’s bid to hold the World Expo in 2020, and adds a win would further increase demand for steel in the future. The winning city will be announced next month.

“We aim to cater to the increasing demand for rebar, bearing in mind the possible developments that can come into place by the last part of this year. If this happens, local demand can conservatively grow in single digits,” adds Bhatia.

Previously known as Conares Metal Supply, the company recently rebranded its identity as Conares ‘Let’s Steel Together’. The company is said to be the only privately owned company in the UAE with an investment of more than $150 million in the steel industry.

“We are leaders in the production of 8 mm to 40 mm rebars and half-inch to 4-inch pipes and tubes. Conares has more than tripled its production capacity in the last 10 years and made strategic investments in Dubai, helping it expand its market share regionally,” says Bhatia.

Established in 2001, the Dubai-headquartered Conares has a diversified and full-fledged manufacturing facility at Jebel Ali Free Zone Authority (Jafza). Centrally located in the UAE, Conares today is the premier provider of quality steel products for the wide-ranging needs in the region.

Conares’ installed capacity is 750,000 tonnes per annum, which will be expanded to one million tonnes by 2015. Its current combined plant utilisation is at 65 per cent, with pipe mill capacity at 40 per cent, galvanising capacity at 100 per cent and rebar capacity at 60 per cent.

“We are considering further capacity increases for the galvanising mill as well as expanding the range of our pipe mill. Consequently an expanded product range will increase capacity as well,” he says.

Conares currently does not have any plans to expand outside the UAE, as it is happy with its current investments in Dubai. “Our clients across wider markets in the region and beyond are within easy access from our headquarters in Dubai, the strategic hub between the east and the west,” Bhatia says.

Conares, which employs around 400 people, currently accounts for 20 per cent of the market share in the UAE and Bhatia says the company has the potential to take the number up to 30 per cent.

It has targeted a turnover of Dh750 million ($204.187 million) for 2013 and Bhatia says the company is on track to achieving and possibly exceeding this target.

The steel products manufactured by Conares are directly related to real estate and infrastructure development. “Conares operates within the flat and long steel product segments with a huge requirement of raw materials, making it key for both global and regional suppliers, giving the company a competitive advantage,” says Bhatia.

Commenting on Conares’ performance so far this year, Bhatia says: “2012 ended with new hopes for us. The current year has been challenging this far, but it has given us a turnover of almost the same levels of 2008.

“We managed to get into new markets and develop new supply chains, while still keeping to the basic balance of principles of conservatism and aggressiveness. Currently, the company exports are close to about 35 to 40 per cent of its production output. The volume of our production can be absorbed in the regional market when it picks up.”

He says the sale of steel is expected to grow up to 240,000 tonnes this year, as compared to the 200,000 tonnes last year, adding that the demand for steel saw a 40 per cent increase during the second quarter this year, as compared to the first quarter of the same year.

Domestic market

Turning to the domestic market, Bhatia says the UAE steel industry is expected to grow by 25 per cent in the current year, with the increasing demand mainly boosted by the growth in the real estate and trading sectors.

“As far as the requirement for rebar is concerned, the UAE market is pretty much balanced. It is estimated to have about 220,000-250,000 tonnes demand per month. And this is practically covered by the installed capacity of the local producers of about 300,000 tonnes per month.”

There are only six firms in the UAE into the steel business but each having different activities and production lines. The demand for steel in the UAE is estimated at three million tonnes per year and this is forcing traders to import from Turkey, the most competitive market.

“Steel imports from Turkey are one of the main challenges to the steel industry in the UAE,” he says. “However, the installed capacity of steel market in the UAE has witnessed a steady growth in 2012 at 2.1 million tonnes and is expected to reach 3.6 million tonnes by the end of 2013.”

However, Bhatia says there are positive signs from the banking fraternity and this is helping promote business across the region.

“A string of new high-profile projects announced recently in Dubai indicates the confidence which has returned in the market, reflecting the growing strength of the property and tourism sectors. The steel segment is likely to leverage the growing investment activities in the UAE, along with the new projects and even more announcements over the course of the year,” he adds.

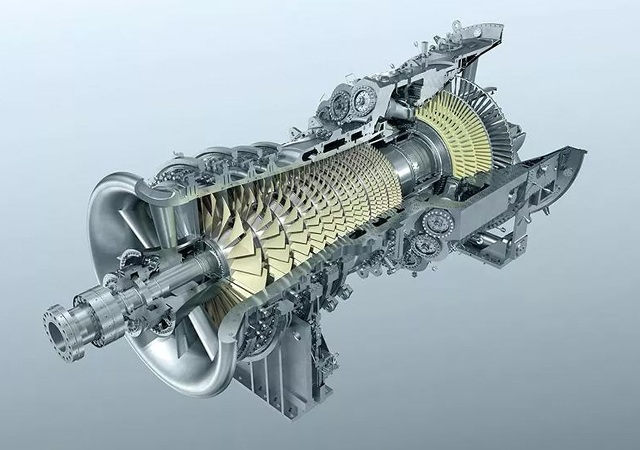

“We see great advantages and benefits of the forthcoming projects across the UAE, including the Etihad Rail project and nuclear plant development in Abu Dhabi. Moreover, Dubai’s new airport in Jebel Ali –Al Maktoum International – Dubai World Central – is well connected with the sea port. This will open up opportunities and encourage businesses from across the world to consider having a presence in the UAE.”

Over the first half of this year, Conares has been busy with catering to demand from ongoing major projects, in particular the Road and Transport Authority’s (RTA) Al Sufouh Tram. It has also supplied its products to the Sharjah Electricity and Water Authority, and developments at Jumeirah Beach Residence (JBR) and Business Bay, to name a few.

Export market

Serving an extensive network of clients including pre-engineering firms, steel traders and construction majors, Conares has developed a strong foothold in several regional and global markets for exports including the GCC states of Saudi Arabia, Kuwait, Qatar, Bahrain and Oman, the Middle East and North Africa (Mena) region including Iraq, the US, Canada, Latin America, Europe, Australia, Russia, Ethiopia, Hong Kong, Singapore, India and Sri Lanka, among others. Its share of exports to the GCC market is 50 per cent.

Bhatia adds that Conares is aggressively exploring opportunities to market its pipes, tubes and rebar to Eastern Europe, in a bid to “further reach into potential markets”.

Developments

Commenting on recent developments within the company and its future plans, Bhatia says: “We are consistently adding markets whenever possible. Last month we participated in The Big 5 India construction exhibition as well. This is the first year that The Big 5 went to India.”

“The diversification plan we are currently contemplating is a lateral movement of what we have at the moment. But we are not discounting the possibility of backward integration. Studies are currently on-going but we would rather discuss this at a more appropriate time when we are better prepared to move forward.

“Conares is planning to enhance its steel processing capacity to provide steel products for wide-ranging requirements, as its head office is based at a very easy accessible location in the UAE, having an extensive network of clients on regular basis.

Quality assurance

For its quality management system, Conares has received Dubai Central Laboratory (DCL) certification in addition to several global accreditations including the UK’s Cares, the Bureau of Indian Standards (BIS), the Sri Lanka Standard Institution, and The Civil Engineering and Development Department (CEDD) in Hong Kong (all for rebar); CE-EU and UL-US (for tubes and pipes), as well as product approvals from Singapore and Pakistan.

“Conares is the only steel manufacturer in the UAE to have BIS, Hong Kong and Sri Lankan certifications,” Bhatia points out, adding that its pipes products are CE approved, and recognised by the Dubai’s Civil Defence authority for sprinkler systems in high-rise buildings.

“We have a fully operational facility with appropriate product certifications to comply with the various international standards demanded for any construction requirement in the country,” says Bhatia. “We have a distinct competitive advantage over imports as our products are readily available. Imports have a lead time of about 30 days, making the products susceptible to price fluctuations.

“The advantages of buying from a local producer include reducing the cost of inventories and the risk of price fluctuation. Being a local manufacturer, we have a stronger social commitment to the local market. This should add value to the procurement consideration of the local industry.”

Bhatia adds that the local construction industry “should patronise locally manufactured products, and further promote the development of the UAE”.

Conares will be exhibiting at Stand A16, Sheikh Saeed Hall-1 at The Big 5 show.

BIG.jpg)

.jpg)

.jpg)

.jpg)

.jpg)