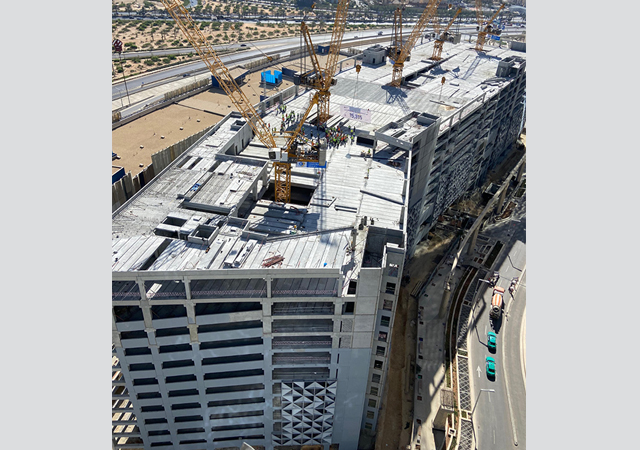

Despite ongoing global challenges such as persistent inflation, elevated interest rates, and geopolitical tensions, the total pipeline value of unawarded construction projects in the Middle East and North Africa (Mena) is set to reach $3.9 trillion, with the UAE holding a significant share at 15%, according to real estate industry expert JLL.

The UAE stands out with a high-value pipeline of $590 billion in the region’s projects market with residential projects accounting for $125 billion (21%), and mixed-use projects representing $232 billion (39%), stated JLL in latest UAE Construction Market Intelligence Report, based on insights gathered from industry sources and experts.

As the dominant leader in the UAE’s real estate market, Dubai is witnessing a substantial 21% year-on-year surge in sales and rental prices, having delivered around 10,000 residential units in Q1 2024.

Approximately 25,000 units are scheduled for delivery by the year-end, taking the total residential stock in Dubai to 754,000 units.

In Abu Dhabi, around 1,600 units were delivered during Q1 2024, with an additional 6,000 units in the pipeline for the remainder of 2024. The capital, which recorded moderate annual increases of 5% in sales prices and 2% in rental rates respectively, is expected to see its total stock rise to 294,000 units this year.

In the hospitality sector, Dubai witnessed the addition of 2,000 hotel rooms to its existing stock in Q1 2024, primarily focusing on the 5-star category.

With another 5,000 keys expected to be added in 2024, Dubai will have a total of 160,000 hotel rooms while Abu Dhabi will add approximately 500 keys this year, bringing its stock to 34,000 hotel rooms.

JLL maintains a positive outlook for the UAE, which achieved a remarkable milestone in 2023 and nearly tripled the value of awarded projects, compared to the previous year.

According to regional projects tracker MEED Projects, the value of these projects stood at $87 billion, compared to $31 billion in 2022, and demonstrates the country’s commendable progress in aligning with its economic diversification and investment goals.

Laura Morgan, Market Intelligence Lead MEA, Project & Development Services, JLL, said: "Riding on the strength of the resilience and promising growth prospects across all sectors in the UAE, the construction market exhibits a consistent upward trend."

"Last year, under buoyant market conditions, the sector contributed $42.9 billion, accounting for nearly half of the total projects awarded. Although the upward trajectory of land and construction costs remain a key challenge in 2024, the strong uptake of new projects will ease the pressure and maintain the sector’s growth momentum through the year," he stated.

According to Oxford Economics, the UAE is poised for a 3.8% GDP growth in 2024, up from 3% in 2023, and is set to see a 3.9% growth in 2025.

Although the S&P Global purchasing managers index (PMI) is at 56.9, a slight dip from February’s index of 57.1, the sector remains in robust growth territory, reveals Emirates NBD Research.

Taking account of historical construction price trends, prevailing market conditions, the value of the project pipeline, and external factors that may impact construction prices, JLL’s forecast indicates that the UAE is expected to observe a tender price inflation (TPI) of 3% in 2024.

The report further reveals that to address rising costs, developers in Dubai may explore the possibility of developing smaller-sized units and projects in secondary areas.

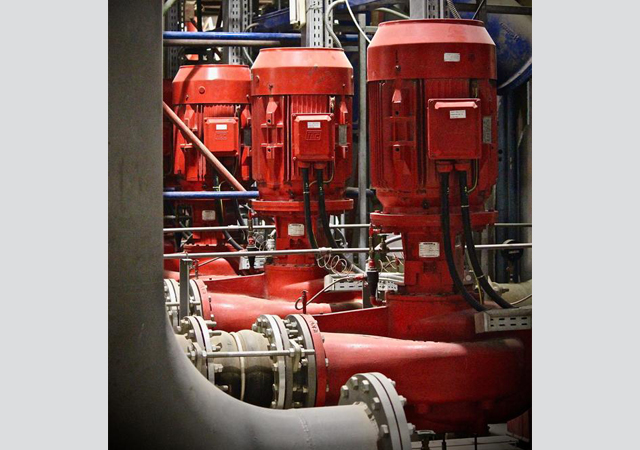

The RICS Global Construction Monitor has noted a boost in construction activity, despite financial constraints arising from increasing material costs, and in certain instances, shortages in materials.

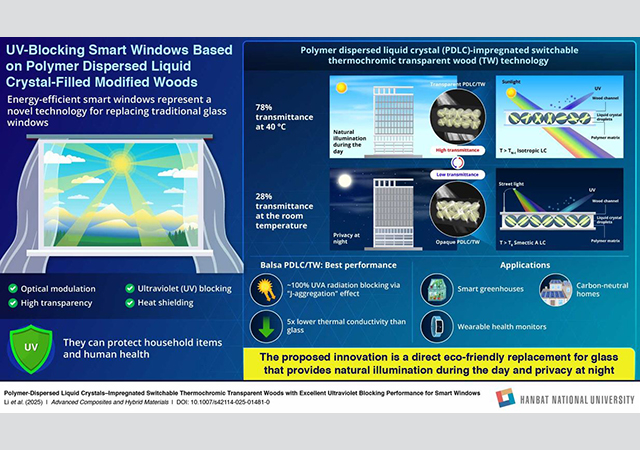

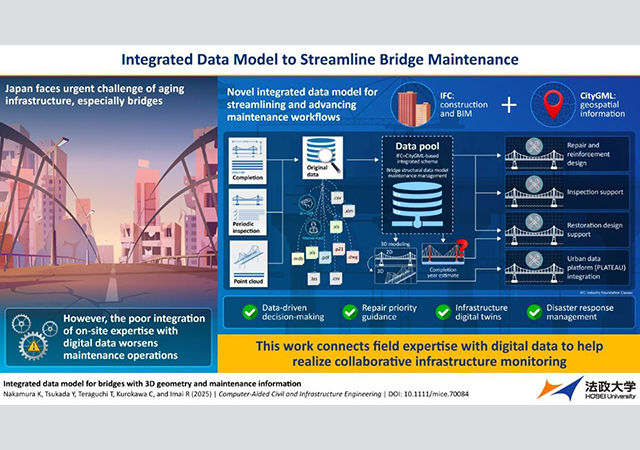

The RICS report has further identified several factors influencing the current UAE construction market, including market competition, demand dynamics, delays related to material, project financing, and the adoption of digital construction processes.

According to latest data from World Bank, oil prices will average $81 per barrel in both 2024 and 2025 while base metal prices are expected to decline by 5% in 2024.

The JLL report acknowledges that price fluctuations in shipping and transportation heavily influence local construction rates due to the increased reliance on imported materials like glazing, facade systems, and timber. From March 2023 to March 2024, freight shipping prices saw a notable increase with the Drewry Index rising from $1,800 per 40-ft container to over $3,000.

However, JLL’s analysis indicates that material availability is currently stable and the medium- to long-term outlook foresees improvements in local manufacturing capabilities.

The World Steel Association (WSA) estimates global steel production to grow by 1.9% in 2024 after a 1.6% decline the previous year. JLL further notes that steel demand is projected to rebound in the Mena region in 2024, fuelled by mega projects and the residential sector.-TradeArabia News Service