ENBD REIT, the shari'a-compliant real estate investment trust managed by Emirates NBD Asset Management, said its net asset value for the year ended March stood at $180 million (or $0.72 per share), down 17% on the previous year.

Announcing its financial results for the year ended March 31, prepared in accordance with International Financial Reporting Standards and audited by Deloitte, ENBD REIT said the total value of the property portfolio fell 12% over last year to $360 million.

Its net rental income (excluding valuation movements) surged by 8% year-on-year, while its loan-to-value ratio stood at 52%.

Downward movement on valuations was driven by the dual pressures of a softening real estate market and pandemic-induced economic pressures that affected gross rental income.

Emirates NBD Asset Management said the occupancy in the portfolio remained healthy, with management providing a range of solutions to support tenants in genuine financial distress in order to secure income.

Meanwhile, in an effort to continue to reduce costs, management reduced fund and portfolio management expenses significantly, while the Fund benefited from lower finance costs due to a lower lending rate environment.

ENBD REIT’s board has proposed a final dividend of $4.4 million (or $0.0176 per share) equivalent to 2.44% of NAV and 4.10% of the share price – for the 6 month period ending March 31, 2021, subject to shareholder approval at the Annual General Meeting.

The total dividend payable to shareholders for the year is $9.25 million (equivalent to 5.13% of the cum-dividend NAV and 8.62% of the share price), said the statement from Emirates NBD Asset Management.

Following the AGM and subject to shareholders’ approval, the shares will trade ex-dividend on July 7, with the record date set as July 8 and the payment date on July 27, it added.

Head of Real Estate Anthony Taylor said: "The 2020-21 financial year was challenging, with soft market conditions exacerbated by the Covid-19 pandemic. During the year, we sought to safeguard occupancy rates to limit downward movement on rental income, while reducing fund and operating expenses throughout the portfolio."

"While occupancy rates were affected by a sustained softening of the real estate market and weak economic indicators, blended occupancy in the portfolio remained healthy, which can be attributed to our active and flexible leasing strategy," he noted.

"We also negotiated the renewal of our largest tenant, Oracle, at The Edge building, for a further five-year term. This agile approach to leasing and cost management has seen net rental income from the portfolio increase 8% year-on-year, excluding valuation movements," he added.

Taylor said earlier in the year, Emirates NBD Asset Management had taken the decision to offer rental relief to tenants who most needed it, which proved important for securing occupancy and long-term income.

"As pressures in the market have continued to impact valuations, we have been using this as an opportunity to renegotiate contractual leases with tenants at lower rates that are in line with market benchmarks, while extending contractual lease terms further into the future," explained Taylor.

"This has enabled material cost savings for tenants during short-term uncertainty, while locking in longer-term occupancy, thereby improving the portfolio’s weighted average unexpired lease term to over 4 years," he added.

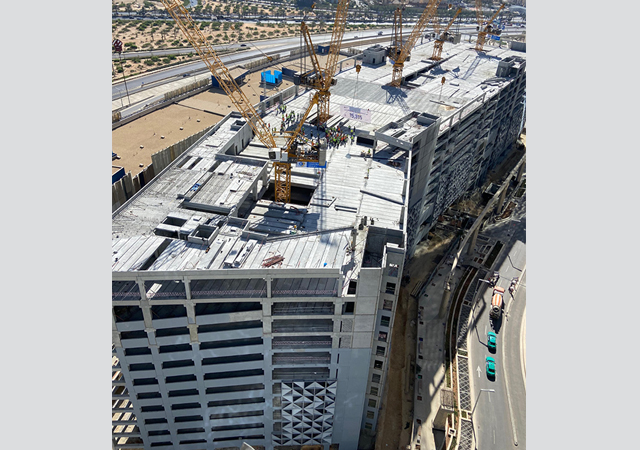

With lower occupancy in some office buildings, we have taken the opportunity to enhance value in the portfolio by initiating several capital work projects, with minimal disruption to occupants.

"These programmes kicked off at the beginning of the calendar year and we expect all projects to be finalized before the end of 2021. The upgrades should add significant value to certain assets, making them more attractive to existing tenants and materially improving the leasability of vacant space," he added.