The Chedi is set to open a stunning boutique hotel in Saudi Arabia’s ancient oasis city of AlUla.

The Chedi is set to open a stunning boutique hotel in Saudi Arabia’s ancient oasis city of AlUla.

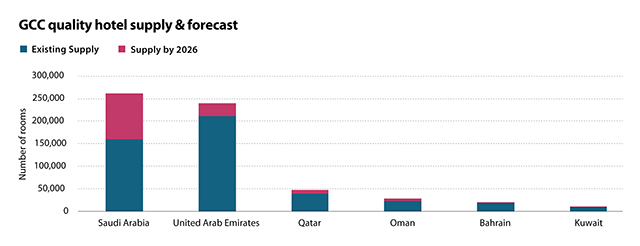

The GCC states are poised for a monumental hospitality expansion, with plans to add nearly 400,000 hotel rooms by 2030. Once heavily reliant on oil, the region is now diversifying its economy through tourism and this shift is evident in the unprecedented growth of hotel infrastructure, surpassing even the most ambitious projections.

Driving this growth are long-term development plans drawn up by the region, such as Saudi Arabia’s Vision 2030 programme, and these aspirations are being catalysed through strategic government initiatives and massive investments in tourism, leisure, and aviation infrastructure.

This vision has translated into giga- and mega projects such as Neom, The Red Sea, Diriyah and Amaala, each of which will add thousands of rooms to Saudi Arabia’s hospitality portfolio.

Saudi Arabia’s ambitious tourism drive accounts for a staggering 80 per cent of the growth in regional hospitality facilities, adding 320,000 hotel keys to its stock, according to leading real estate consultancy Knight Frank’s inaugural annual GCC Hospitality Market Review for 2024.

Dubai, already a global tourism powerhouse, continues to impress and maintain its enduring appeal, having emerged as the world's third most visited city in 2023. Its 154,000 hotel rooms welcomed 17.2 million visitors, and this momentum has persisted into 2024. A total of 9.3 million tourists arrived in the city in the first half of this year, representing an increase of nine per cent on H1 2023.

Not to be outdone, Saudi Arabia has also seen impressive growth, attracting 27.4 million visitors in 2023, and its meteoric rise positioned it as the world's 13th most visited country last year, said the report.

|

|

Once complete, Amaala on the Red Sea coast will be home to more than 3,900 hotel rooms across 29 hotels and 1,200 luxury homes. |

According to Knight Frank’s report, the Gulf states will together add 392,000 hotel rooms to their total stock by 2030. The hospitality sector across the GCC has experienced impressive growth in occupancy levels and average daily room rates (ADR) over the last few years.

The hospitality and tourism sector plays a pivotal role in many of the GCC’s transformation and vision programmes such as the Saudi Vision 2030, which is forecasting 150 million visitors to the kingdom by 2030, and Dubai Economic Agenda (D33) in the UAE.

Faisal Durrani, Partner – Head of Research, Mena, commented: “The synergy between a robust economy and a dynamic, vibrant hospitality and tourism sector is evident across the region as the GCC states collectively pursue an economic future that is far less reliant on oil than it is today. The UAE, and Dubai in particular, has blazed a trail in this regard with the travel and tourism sector now accounting for around 11.7 per cent of the UAE’s economy, proving not only that it can be done, but creating a blueprint for other markets in the region to build on and adapt.”

|

|

GCC quality hotel supply forecast |

Despite almost uniform national efforts by GCC governments, there have been disparities in the performance of the region’s hospitality sectors, according to Knight Frank.

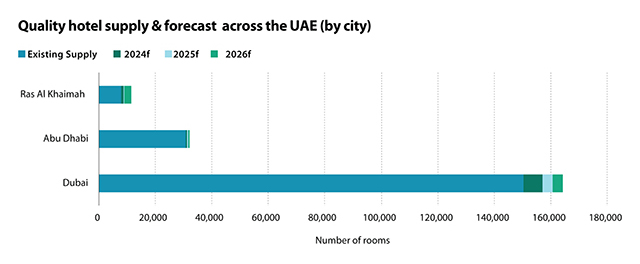

The UAE remains the largest hospitality market in the GCC, with current hotel stock standing at 212,000 quality hotel rooms, 154,000 of which are in Dubai alone. Assuming the planned completion of ongoing construction, Knight Frank expects this supply to increase by 10 per cent to 232,000 keys by 2026.

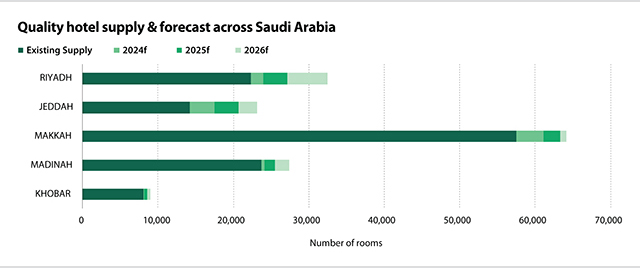

As of the end of June, Saudi Arabia’s current hotel stock stood at 159,790 quality hotel rooms. With ongoing construction, Knight Frank is forecasting this supply to rise by 29 per cent to 205,500 by 2026, assuming projects are completed as planned. Riyadh alone is poised to experience a 46 per cent increase in quality hotel rooms to 32,500 by 2026.

Around 200+ hotel keys were added to Kuwait’s total quality stock of around 10,300 rooms, with no additional rooms due to be completed this year. The quality room supply in Kuwait is expected to reach 10,770 keys by the end of 2026.

In Bahrain, the hospitality sector has shown resilience and growth. The overall hotel room supply has continued to expand, with current figures showing approximately 19,000 quality room keys available, a slight increase over previous years. By the end of 2026, the quality room supply in Bahrain is expected to reach 20,600 keys.

According to Knight Frank, the GCC's current hotel stock stood at 464,465 quality rooms as of the end of June 2024, of which 46 per cent (212,000 keys) are in the UAE and 34 per cent (159,800 keys) are in Saudi Arabia. With ongoing construction, this supply is expected to increase by 17 per cent to 544,250 by 2026, assuming projects are completed as planned.

Let’s take a closer look at the two of the region’s largest markets:

Saudi Arabia

Saudi Arabia surpassed its initial tourism target of 100 million annual visitors seven years ahead of schedule, with 77 million domestic travellers and 27 million international tourists in 2023. The new target is 150 million annual visitors by 2030: 80 million from within the country and 70 million from abroad.

Key to this growth is the substantial influx of visitors from Muslim-majority nations, with Bahrain (2.2 million), Kuwait (1.9 million) and Egypt (1.5 million) emerging as the top three source markets, according to Knight Frank, which said that religious tourism remains the cornerstone of Saudi Arabia’s tourism strategy.

|

|

Quality hotel supply forecast across Saudi Arabia |

Some 27 million pilgrims visited the country in 2023 – almost treble the pre-Covid number of 10 million. Around 221,000 new hotel rooms are planned for Makkah and Madinah, to accommodate the influx.

The country has 362,000 new hotel rooms planned or under construction and is expected to deliver 320,000 new hotel rooms – with a development cost of $37.8 billion – by 2030 as part of its unprecedented investment in infrastructure, tourism transformation and real estate, according to Knight Frank.

The kingdom – where tourism spending reached almost $40 billion last year, up nearly 43 per cent on 2022 – aims to more than treble its current number of hotel keys in line with Vision 2030, with a plethora of new hotels, resorts and tourist attractions scheduled to open in the next six years, it said.

Knight Frank’s analysis shows that 66 per cent of the kingdom’s existing hotel supply falls into the luxury and upscale categories. By 2030, this segment of the market will expand to 72 per cent, equating to around 251,000 hotel rooms.

Riyadh’s winning of the bid to host the 2030 World Expo is expected to inject a substantial economic boost of $94.6 billion into the nation’s capital, with an estimated 40 million visitors expected during the six-month exhibition, and the 2034 Fifa World Cup in Saudi Arabia promises further momentum for the country’s tourism goals.

UAE

The UAE’s hospitality sector is set for further growth, with 26,832 new hotel rooms due to be completed by 2030, a 12.7 per cent increase on 2024, which will take the total number of hotel rooms to 238,412, according to Knight Frank’s annual UAE Hospitality Market Review for 2024.

The consultancy expects the new supply to support the government’s vision of hosting 40 million tourists by 2030. Two-thirds of the new supply, or 17,750 hotel rooms are being developed in Dubai.

The tourism and hospitality sector grew by 26 per cent, representing 11.7 per cent of the UAE’s GDP in 2023, translating into a record-breaking contribution of AED219 billion ($59.8 billion). The government has set a target to grow this further still to $123 billion target by the end of the decade.

|

|

Quality hotel supply forecast across the UAE |

Citing STR data, Knight Frank says that between January and July 2024, the UAE emerged as a standout performer, with an average hotel occupancy rate of 76 per cent – the highest level in the region.

Durrani stated: “The tourism and hospitality sector is a cornerstone of the UAE economy and has been for some time. As the D33 Agenda unfolds, there will undoubtedly be more hotel developments being unveiled in Dubai, particularly if it is to hit its 2033 target of emerging as a Top 3 global destination for leisure and business. The city is already home to 154,000 rooms. Going forward, the Palm Jebel Ali and Dubai Islands, which together boast plans for 160 hotels and resorts, will likely be key contributors to Dubai’s 2033 targets.”

According to Knight Frank, 69 per cent of existing hotel supply in the UAE falls into the luxury, upper upscale and upscale category, highlighting the importance of continued development of more mid-low hotel accommodation to cater to budgets at all levels. Some 67 per cent of the existing supply comprises of internationally branded operators with 24 per cent belonging to local brands. By 2030, 82 per cent of the country’s hotel supply will be operated under international brands, with the proportion of local brands slipping to just 10 per cent of market share, according to Knight Frank.

Dubai, as a global destination, is known for its luxury accommodation with an estimated 52,995 luxury five-star hotel rooms, and 14 Michelin-star restaurants.

Turab Saleem, Partner – Business Development – Hospitality, Tourism & Leisure Advisory, MEA, said: “The emirate currently has 154,000 hotel keys, higher than London, or New York, while hotel occupancy levels have been the amongst highest in the world, averaging 77 per cent between January and July 2024. According to our sources, the number of international tourists in Dubai has grown by 8 per cent in H1 2024 translating into 10.62 million visitors. Dubai’s top source visitor markets comprised Western Europe at 20 per cent, followed closely by South Asia at 17 per cent and Eastern Europe (14 per cent).”

Dubai is set to see the addition of 17,750 rooms by 2030, it added. The UAE capital, Abu Dhabi, however, has a larger development pipeline of 37,148 keys, with another 8,764 new rooms expected in Ras Al Khaimah by the end of the decade.

Daniel Pugh, Partner – Head of Hospitality & Leisure Valuation & Advisory, concluded: "The historic twin announcements in April this year to transfer all operations from Dubai International to Al Maktoum International as well as the commencement of construction on the first phase of the new $35 billion airport marks a momentous milestone in Dubai’s epic rise over the last 50 years as a global commercial, trade, finance and tourism centre.”

“Dubai’s global appeal, world-class attractions, infrastructure and plethora of outstanding accommodation options look set to be further bolstered by the addition of 17,750 rooms, driving the city’s total hotel supply to 169,165 keys by 2030 – and that’s what we know about so far,” he added.

.jpg)

(1).jpg)

_master.jpg)