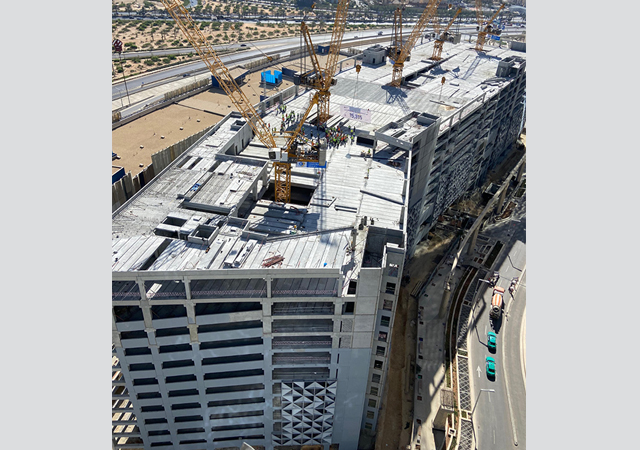

Saudi Arabia is undergoing a momentous economic transformation, capturing global attention with its ambitious developmental projects. The kingdom’s landscape is being enriched with mega-projects that are steadily marching towards completion while fresh initiatives continually emerge, cementing its status as the focal point of the construction industry worldwide.

While eye-catching projects – such as the New Murabba and the anticipated 2-km tower in Riyadh – make the headlines, the focus has shifted towards implementation. Across all construction sub-sectors – be it hospitality, housing, industry or utilities – exponential growth is witnessed as Saudi Arabia races towards achieving its tourism, housing, and urban development objectives. As the spotlight shifts towards realising projects aligned with the kingdom’s Vision 2030, no effort is spared in attracting the best minds, machinery and manpower to materialise its visionary aspirations.

There have been reports recently regarding the scaling down of Neom’s ground-breaking project, The Line, a revolutionary 170-km development extending from the Red Sea coast. However, Neom has just silenced doubters by securing a SR10-billion ($2.7 billion) financing facility, demonstrating global confidence in the giga-project, while its Chief Operating Officer issued an update on The Line to refute these media reports.

Saudi Arabia’s construction market now leads the Middle East and North Africa, boasting an estimated value of $70.33 billion in 2024, with projections soaring to $91.36 billion by 2029, according to a market intelligence report by International Trade Administration of the US.

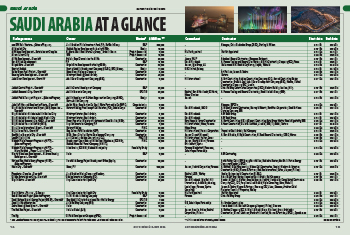

|

|

The Red Sea project has made impressive progress over the past year. |

The country accounts for more than half of the contracts (52.2 per cent) awarded in the GCC region during Q1-2024 with the total value aggregating to $23.5 billion against $19.1 billion in Q1-2023, shrugging off underwhelming GDP growth projections by the IMF, says a Kamco Invest report.

Supported by the astute Public Investment Fund (PIF), the kingdom’s sovereign wealth fund, monumental projects like Neom, a $500-billion avant-garde city in the northwest of the kingdom; The Red Sea Project, a $23.6-billion eco-conscious luxury tourism venture on the Red Sea coast; Diriyah, the $63.5-billion redevelopment of Riyadh’s ancient city; and Qiddiya, a $9.8-billion entertainment and leisure hub, demonstrate awe-inspiring progress.

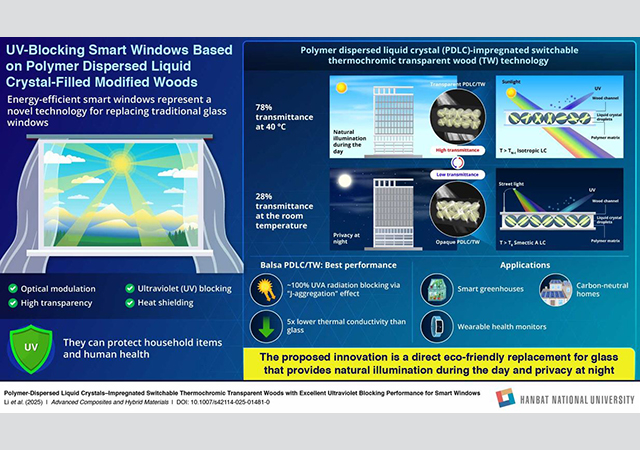

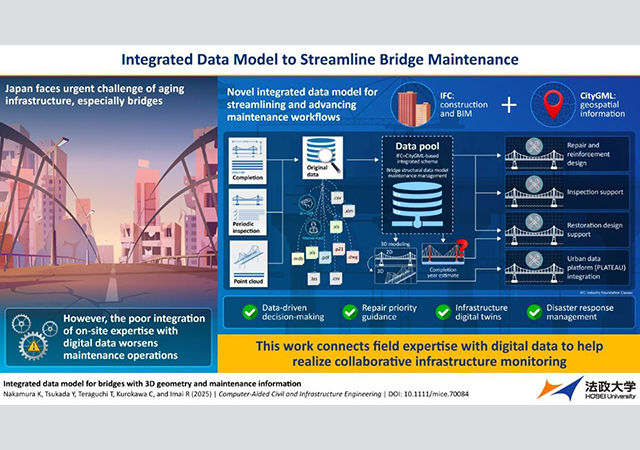

Beyond traditional core elements, the industry embraces cutting-edge technologies including 3D printing, modular and prefabricated construction, building information modelling (BIM) software, Internet of Things (IoT) integration, smart devices, as well as augmented and mixed reality applications.

Targeted approach

After being aggressive on all fronts of project development, recent reports have shown a change in strategy for the kingdom wherein it is expected to have a more focused approach. For instance, there is a renewed emphasis on completing modules at the marina within The Line, an integral component of the Neom city project. Additionally, on the funding front, external sources, including debt issuance by various project stakeholders, are anticipated to play a significant role.

The Kamco Invest report underscores the acceleration of Vision 2030 initiatives, reflected in the expedited pace of project allocations. A prime example is the $1.8-billion contract awarded by the Jeddah Central Development Company to the China Railway Construction Corporation for the construction of the Jeddah Central Stadium. This award is part of four projects granted by the company in Q1-2024, with a combined estimated value of $3.2 billion, says the report.

|

|

Excavation work in progress at Sharaan Resort in AlUla. |

Given its far-reaching ambitions, Saudi Arabia is unlikely to reduce project spending in 2024 despite the annual budget seeing a decline in expenditure compared to the actual estimate of 2023 spending, which has been put at SR1.28 trillion, according to Jadwa Investment, a leading investment management and advisory firm in the Mena region.

“Project activity is gathering pace and the recent award of the 2030 World Expo will only add to this momentum. In addition, project input costs (both labour and material) are rising and it will be difficult for the government to reduce capex next year (2024). Moreover, there does not seem to be any pressing need to do so, with both public sector savings and debt headroom substantial,” said Jadwa Investment.

Riyadh’s winning of the bid to host the 2030 World Expo is expected to inject a substantial economic boost of $94.6 billion into the nation’s capital, with an estimated 40 million visitors expected during the six-month exhibition, and the 2034 FIFA World Cup in Saudi Arabia promises further momentum for the country’s tourism goals, said the report.

Mega Projects

Most of Saudi Arabia’s 15 giga-projects have made significant progress. The largest of them, the $500-billion Neom has unveiled plans for some 10 new tourist destinations since last October, while work continues on multiple fronts on its key components – the luxury island destination Sindalah, the snow-capped mountain destination Trojena, the revolutionary linear city The Line, and the advanced industries hub Oxagon (see Pages 16-20).

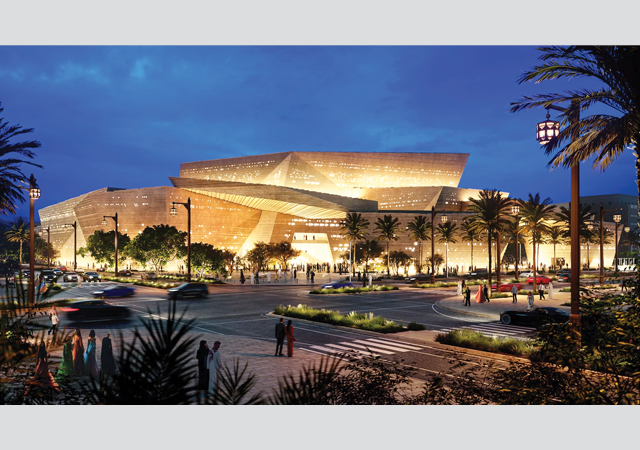

The Diriyah redevelopment has seen the popularity of its dining destination Bujairi Terrace grow since it was opened in late 2022. The ambitious project has, over the past year, unveiled plans for cultural destinations such as an opera house and a 20,000-seat Arena, followed by the most recent launch of Zallal, its inaugural versatile commercial office and retail project, slated to debut in the Bujairi District (see Pages 26-27).

|

|

Treyam ... one of the 10 new tourist destinations unveiled at Neom. |

Similarly, Qiddiya, Saudi Arabia’s emerging entertainment hub, is evolving to be an adrenaline-pumping and gaming destination, which has newly unveiled plans for a Speed Park racetrack and the Dragon Ball theme park, having earlier announced its intention to set up a Gaming and Esports District (see Pages 22-24).

Two of the four mega projects launched by Saudi Arabia’s King Salman bin Abdulaziz Al Saud in 2019 in Riyadh, King Salman Park and Sports Boulevard, have been making headway as part of Riyadh’s drive to position itself among the most liveable cities and increase its greenery.

Saudi Arabia is also taking the lead in terms of greening initiatives, and has embarked on a plan to plant 10 billion trees under the Saudi Green Initiative, a project spearheaded by His Royal Highness Prince Mohammed bin Salman bin Abdulaziz Al Saud, Crown Prince, Prime Minister, and Chairman of the Higher Committee for the Saudi Green Initiative.

Planting 10 billion trees amounts to one per cent of the global greening target and 20 per cent of the Middle East Green Initiative’s afforestation target of planting 50 billion trees across the region.

Meanwhile, excavation work has been launched on Riyadh’s new downtown area – the largest of its kind in the world – New Murabba, which will be anchored by the iconic cube-shaped landmark, the Mukaab (See Page 9).

Hazy details have also emerged of the kingdom’s plans to build 2-km-high megatall tower – more than double the height of the world’s tallest building Burj Khalifa in Dubai – as part of an 18-sq-km masterplanned development to the north of Riyadh.

The current contender for the title is the 1,000-m-plus Jeddah Tower, work on which is widely expected to resume soon with the selection of the main contractor for the project (See Page 13).

|

|

The Rig, a world-first tourism destination on an offshore oil platform. |

Back at the Red Sea coast, The Red Sea Project has opened to tourists with its airport now receiving flights from key regional destinations and two of its resorts hosting guests. Upon completion in 2030, The Red Sea destination will comprise 50 resorts, offering up to 8,000 hotel rooms and more than 1,000 residential properties across 22 islands and six inland sites (see Pages 31-33). Its developer Red Sea Global (RSG) is also developing another regenerative tourism destinations Amaala, also on the Red Sea coast, which will include a number of hospitality and wellness resorts.

Saudi Arabia, in fact, is expected to deliver 320,000 new hotel rooms – with a development cost of $37.8 billion – by 2030 as part of its unprecedented investment in infrastructure, tourism transformation and real estate, according to leading real estate consultancy Knight Frank.

The country aims to more than treble its current number of hotel keys in line with Vision 2030, with a plethora of new hotels, resorts and tourist attractions scheduled to open in the next six years, says the leading real estate consultancy.

|

|

The Islamic Village which will be part of the Rua Al Madinah development in Madinah. |

Saudi Arabia has surpassed its initial tourism target of 100 million annual visitors seven years ahead of schedule, with 77 million domestic travellers and 27 million international tourists in 2023. The new target is 150 million annual visitors by 2030: 80 million from within the country and 70 million from abroad.

Some 27 million pilgrims visited the country in 2023 – almost treble the pre-Covid number of 10 million. The number of Umrah performers from abroad skyrocketed to a record-breaking 13.56 million, exceeding the 2023 target of 10 million and nearly doubling a baseline of 6.2 million. Around 221,000 new hotel rooms are planned for Makkah and Madinah.

Airports

A key enabler in achieving these high tourist numbers will be the kingdom’s aviation infrastructure. In line with this, Saudi Arabia has confirmed its determination to push ahead with the mega King Salman International Airport project in Riyadh, with the appointment of British engineering consultancy Mace as the lead consultant providing project management, design management, cost consultancy and procurement services on the massive development.

On completion, the airport will be the world’s largest spread over a sprawling 57-sq-km area with six parallel runways. It will also include the existing terminals at King Khalid International Airport in addition to 12 sq km of airport support facilities and other logistics real estate. The airport aims to accommodate up to 120 million passengers by 2030 and once fully operational, it will boast a capacity of 185 million passengers by 2050 annually.

|

|

King Salman International Airport ... designed to be the world’s largest airport project. |

For the giant airport project, Saudi authorities had sealed deals with a host of top global players in the airport construction sector. Its masterplan was designed by British architect Foster + Partners, while US-based Jacobs handled the infrastructure design. The new airport aims to achieve LEED Platinum certification by incorporating cutting-edge green initiatives into its design and will be powered by renewable energy. It will also have a dedicated terminal for the country’s national carrier, Saudia.

Another key development in the aviation sector is the Abha International Airport in the Aseer region. The project is expected to be carried out with the participation of the private sector. Matarat Holding Company – which manages the kingdom’s airports and monitors the operations of 27 airports in the country through its subsidiaries – and The National Center for Privatization & PPP (NCP) had invited expressions of interest (EOI) from leading companies for the development of the facility, which will cover an estimated area of 4.6 sq km, and be implemented in two to three phases.

Under Phase One, a new terminal building will be set up on a total area of 69,400 sq m by 2028, followed by its expansion to 73,200 sq m in the second phase. Once completed, the Abha airport will be able to accommodate eight million passengers by 2030, increasing gradually to more than 13 million passengers by 2054.

Work is also in progress on the Red Sea International Airport which will serve the regenerative tourism destinations of Red Sea Project and Amaala.

Meanwhile, Egis, a global player active in the consulting, construction and engineering sectors, said it has secured two major contracts from Saudi Arabia’s Royal Commission for AlUla to undertake several projects related to the development of the private aircraft terminal, otherwise known as a fixed based operator (FBO), at AlUla’s International Airport.

Housing

On the social housing front, more than 66,000 Saudi families have received their new homes since the launch of Vision 2030 eight years ago, and more than 24,000 new housing units were given the go-ahead by the end of August last year. The percentage of citizens owning their homes has reached 63.74 per cent, surpassing the 2023 target of 63 per cent, a significant progress from a baseline of 47 per cent, with the ultimate Vision 2030 goal set at 70 per cent.

|

|

The proposed opera house in Diriyah ... designed by Snøhetta. |

The PIF-backed Roshn Group, which was set up with the mandate to boost the home-ownership levels in the kingdom, has played a key role in boosting these numbers. Roshn continues to make the headlines with new community developments in multiple regions of the kingdom – the most recent having been in Makkah and Dhahran. The national developer has embarked on plans to build more than 150,000 homes to date across the kingdom, having launched seven residential and mixed-use projects in four key regions – Riyadh, Jeddah, Eastern Province and Makkah, with expansion planned into further regions (see Pages 28-30).

Another organisation playing a key role in the housing sector is National Housing Company (NHC), the investment arm of the initiatives and programmes of the Ministry of Municipal and Rural Affairs and Housing in the real estate, residential and commercial sectors. NHC has recently tied up with Talaat Moustafa Group (TMG), a leading regional real estate developer, to develop more than 27,000 residential units for Saudi families as part of its Benan City project coming up in the Al Fursan suburb of Riyadh. Spread across an area of 10 million sq m in northeastern Riyadh, the Benan City aims to integrate high-quality, sustainable services such as healthcare, education, commerce, sports facilities, and other public amenities. The entire Benan Project will boast over 50,000 housing units across an expansive 35 million sq m area that will accommodate more than 250,000 residents.

|

|

Jeddah Central Project’s new opera house ... being built by Modern Building Leaders. |

NHC had earlier joined hands with Saudi-based Retal Urban Development Company to develop more than 1,100 residential units in Riyadh and Jeddah at a total investment of SR925 million.

Retal’s subsidiary Building Construction Company is also developing 352 residential units in NHC’s Sadayem suburb of Jeddah at an estimated cost of SR214 million. The Sadayem suburb covers a total area exceeding 3.8 million sq m and houses over 8,000 residential units. Other developers on the project include Mayar for Development and Real Estate Investment Company, Dar and Emar for Real Estate Investment and Development Company, Mohamed Al Habib and Partners Company, Ajdan for Real Estate Development Company, Thabat Al Maskan Real Estate Company, and Ebar Al Mamlaka Real Estate Company.

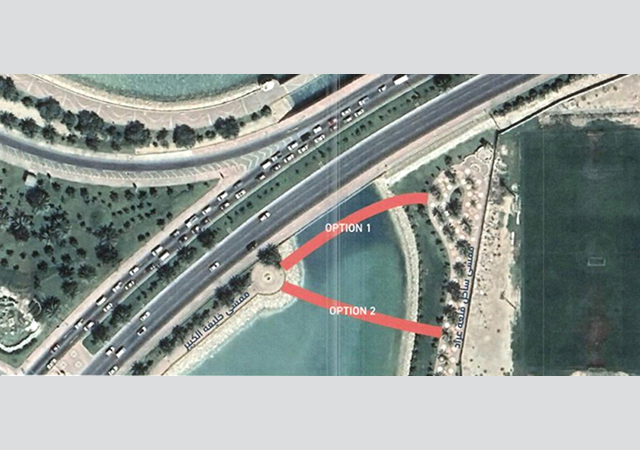

Railways & Metro

While news is awaited on the final completion and launch of the Riyadh Metro, plans for Phase Two development with the construction of Line 7, which will link Qiddiya City, King Salman Park, Diriyah, New Murabba and King Khaled International Airport, are now on the cards.

Meanwhile, the $7-billion Landbridge is now moving ahead with the selection of a consortium of Italian consulting and project company Italferr, Spanish engineering group Sener and US-based construction management expert Hill International for a project management consultancy (PMC) contract for the project.

With the project management contract now confirmed, local media reports suggest that Saudi Arabian Railways (SAR) is preparing to start work on the public-private partnership (PPP) project, which includes constructing the new 950-km railway between Riyadh and Jeddah.

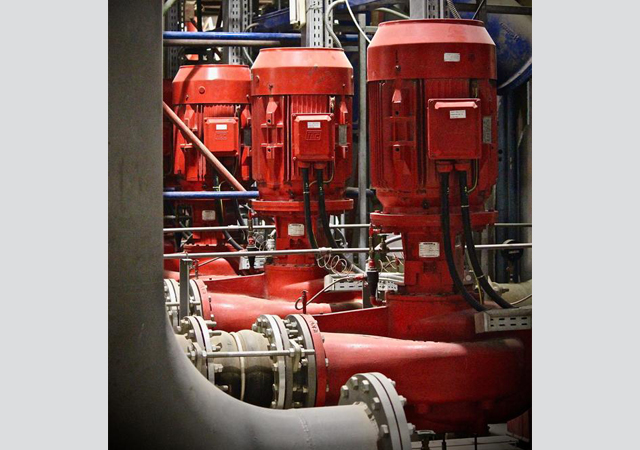

Power & water

Saudi Arabia’s power and water sector is undergoing significant transformation with a focus on increasing renewable energy production, expanding desalination capacity, and improving efficiency.

The kingdom is pushing for renewable energy with major projects under way. According to Saudi Power Procurement Company (SPPC), 23 global developers have been prequalified for a total of 3.7 GW of solar projects. The Round 5 Solar Projects comprise the 2000MWac capacity Al Sadawi IPP to be located in the Eastern Province; 1000MWac Al Masa’a IPP in Hail Province; 400MWac Al Henakiyah 2 IPP in Madinah Province; and 300MWac Rabigh 2 IPP in the Makkah Province.

Three other solar IPP projects being developed are Ar Rass 2, Saad 2, and Al Kahfah. PIF and Acwa Power have signed power-purchase agreements (PPAs) with the SPPC for these projects with a combined capacity of 4.55 GW. The IPP solar projects are part of the National Renewable Energy Programme (NREP).

SPPC has also invited bids for four natural gas power plants with a combined capacity of 7.2 GW, with carbon capture technology readiness. These are distributed across two power plants in the central region (Rumah1 and Rumah2), and two in the eastern region (Nairyah1 and Nairyah2), with a capacity of 1,800 MW per plant. In addition, SPPC has signed for conventional independent power plant (IPP) projects – Taiba-1, Taiba-2, Qassim-1, and Qassim-2 – totalling 7.2 GW capacity, with consortiums led by Al Jomaih Energy and Water, Saudi Electricity Company (SEC), and Saudi-based utility project developer Acwa Power.

Meanwhile, a consortium led by Acwa Power has secured financial closure for the Al Shuaibah solar projects which is being developed in Jeddah at a total investment of $2.37 billion. With a 2,600 MW capacity of clean energy, Al Shuaibah (comprising Al Shuaibah 1 and 2 projects) is set to become the world’s largest solar project once it gets operational in 2025, said Acwa.

In the water desalination sector, requests for proposals (RFPs) were issued early this year for Jubail 4 and 6 Independent Water Projects (IWP) with a total capacity of 600,000 cu m per day. The projects, which will use seawater reverse osmosis desalination technology, are set for commercial operations in Q3 2027.

Another key IWP – Rabigh-4 – achieved financial close at the end of last year. Rabigh-4 IWP, a 600,000-cu-m-per-day capacity project, is set to service the Makkah and Madinah regions. A consortium led by Acwa Power with partners Bahrain-based Almoayyed Contracting Group and Haji Abdullah Alireza Company, Haji Abdullah Alireza & Partners Company have been selected to develop the project.

Tourism facilities

In line with Saudi Arabia’s concerted drive to boost tourism numbers, several cultural destinations and awe-inspiring and first-of-their-kind projects are taking shape in the kingdom. The PIF, under its subsidiaries such as Saudi Entertainment Ventures (Seven), Soudah Development and AlUla Development Company, is spearheading the development of most of these tourism hubs in the kingdom.

Among such projects, key developments are planned for Al Ula, including the world’s longest battery-powered tramway which will be built in the ancient city; Aman AlUla, a joint venture luxury resort project with an expansive Aman resort and branded private residences; Sharaan Resort, a luxury resort currently being built directly into the mountains with a focus on sustainability. AlUla will also host the Chedi Hegra (heritage boutique hotel in the Unesco World Heritage Site); Dar Tantora by The House Hotel (an eco-lodge in AlUla Old Town), Azulik AlUla Resort (an eco-luxury property with 76 villas), as well as museums including the contemporary art museum and museum of the Incense Road, for which key architects have been appointed.

Some of the major tourism projects include:

• The Rig: A world-first tourism destination on an offshore oil platform. It will be located 40 km off the eastern coast of Saudi Arabia and will feature hotels, amusement parks, water sports facilities, and helipads. The project will be developed by the Oil Park Development Company (OPDC), a PIF company.

• Soudah Peaks: A year-round luxury mountain tourism destination located on Saudi Arabia’s highest peak. The project, which is being developed by Soudah Development, will feature six unique development zones and high-end hospitality services. Parsons Corporation has been appointed to provide project management consultancy services for the development of the project.

• Seven Abha: The largest entertainment destination in Aseer region, involving an investment of $346 million. Seven Abha will feature eight attractions including a family entertainment centre, themed edutainment attractions, and an indoor golf course. Saudi-based Modern Building Leaders (MBL) has been signed up by Seven to carry out the construction works.

• Seven Yanbu: A $293-million entertainment destination under development on the seafront promenade on Al Nawras Island in Yanbu. It will include attractions like a carnival-themed family entertainment center, cinema, bowling alley, and adventure golf course. A joint venture of Al Bawani and UCC Saudi has been awarded the contract to build its new entertainment destination.

Real Estate

Saudi Arabia’s real estate sector is experiencing significant growth and diversification, driven by government investment and ambitious development plans.

Among the most ambitious projects on the cards is the North Pole Project, a 306-sq-km development in Riyadh featuring residential neighbourhoods, commercial areas, and a variety of entertainment facilities. The centrepiece of the project is the proposed record-breaking 2-km-tall skyscraper – Rise – which is reportedly being designed by Foster + Partners.

Meanwhile, King Abdullah Financial District (KAFD), Riyadh’s iconic mixed-use financial district is undergoing significant expansion with new office buildings, hotels, and infrastructure projects. Parsons Corporation has been awarded a contract to manage this expansion. Design-and-build contracts were awarded to the Mohammed Alrashid Trading & Contracting Company (Marco) for key projects within the development; while a joint venture of Saudi Constructioneers (Saudico) and the interiors unit of UAE group Alec secured the fit-out contract for a new 16-storey luxury hotel in KAFD.

Another key project King Salman Park, which is being built on more than 16 sq km to become the largest urban park, is developing a mixed-use real estate development within its precinct. The King Salman Park Foundation (KSPF) has joined hands with Saudi developer Naif Al Rajhi Investment Company for the launch of the mixed-use project at a total investment of SR4 billion. Spread over a 290,000-sq-m area, the project will boast over 1,500 residential units that will include Salmani-style apartments and townhouses overlooking the park, along with 140,000 sq m of gross leasable areas for offices and retail facilities, hotels, schools, and several educational, health, sports, recreational and social facilities.

Also being developed in Riyadh is the Mohammed Bin Salman Nonprofit City (Misk), the first non-profit city in the world, which aims to become a robust thriving and an ambitious community to attract organisations that contribute to achieving the goals of the Misk Foundation in sectors such as education, entrepreneurship and the nonprofit sector. Bill & Melinda Gates Foundation has recently signed an agreement to establish its regional office in the city.

In Makkah and Madinah, massive developments that include luxury international hotels and mega malls, are under way to cater to the surging number of pilgrims that visit these holy cities throughout the year.

In Makkah, work is under way on hotel projects at the $27-billion Masar Destination, which is being developed by Umm Al Qura for Development and Construction Company. The cultural destination aims to transform the western part of Makkah under an ambitious redevelopment programme. The masterplan of Masar Destination includes 3.8 million sq m of buildings serving the hospitality sector comprising 40,000 hotel rooms and apartments; 2.1 million sq m of residential buildings offering 10,000 homes; a 317,870-sq-m commercial zone; 987,000 sq m of office spaces; 28,700 sq m of public service centres; and 272,290 sq m dedicated to health services.

A major development in Madinah is Rua Al Madinah, a mixed-use development featuring over 47,000 hotel units and an Islamic Civilisation Village showcasing Islamic heritage. Saudi-based Rua Al Madinah Holding has signed up Jacobs, a global provider of construction services, to provide design services for 12 hotel brands coming up within the mega -use development. Spanning an estimated 1.5-million-sq-m area, the Rua Al Madinah project will boast 47,000 hospitality units that will cater to 149,000 visitors by 2030.

In the Eastern Province, Saudi-based Adel Real Estate has unveiled the blueprints for its mega project – Adel District – in Dammam. Spanning 5.6 million sq m, the plot-based urban development will boast over five residential neighbourhoods that can accommodate 50,000 people.

Meanwhile, construction work has been launched on The Avenues Khobar, a premium mixed-use project by Mabanee featuring a commercial complex, entertainment spaces, hotels, residences, and medical facilities. A construction contract for the first phase, valued at $985 million, was recently awarded by Mabanee for the development coming up over a 197,670-sq-m area. Work is currently in progress on Mabanee’s mega mall in Riyadh (see Page 34).