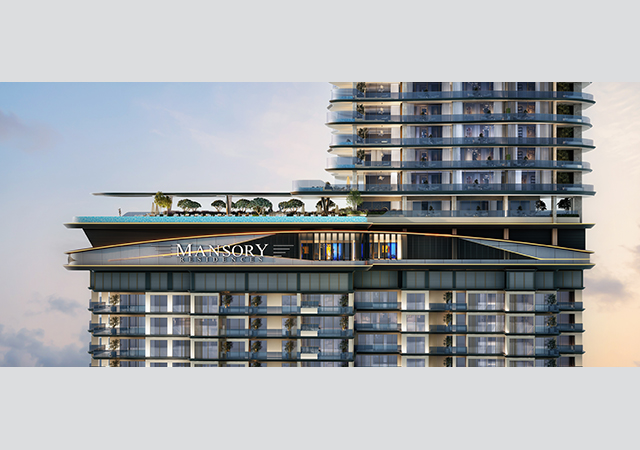

Dubai-based Samana Developers has announced that it will invest AED12.5 billion ($3.4 billion) in new residential projects in Dubai over the rest of this year. In addition, the company will award 18 construction contracts this year, it said.

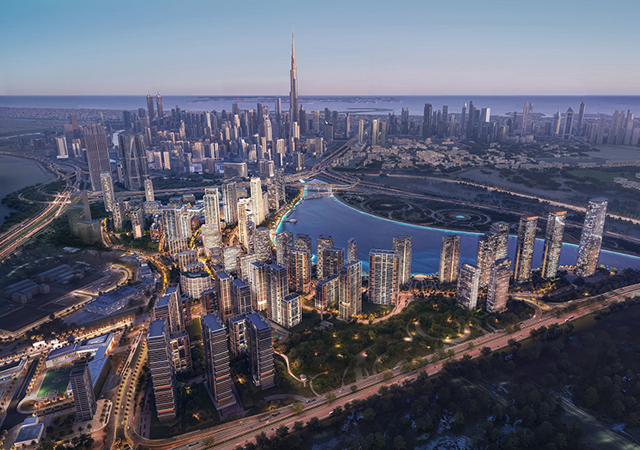

Samana is expanding its portfolio to the waterfront developments which will further push Samana’s position as a top growth player in the emirate. The game-changing investment, mostly in the waterfront projects, will position Samana Developers in the top-five fastest-growing developers in Dubai, moving up from top 10 developers achieved in 2023, it said.

“Dubai’s property market presents an exceptional opportunity, and we are well-positioned to capitalise on it,” Imran Farooq, CEO of Samana Developers said, adding: “By introducing high-yield waterfront properties, we’re set to provide investors with a lucrative asset class that offers the best of Dubai’s sun, sand, and sea lifestyle.”

Over the rest of the year, Samana Developers will award 18 construction contracts and will partner with leading contractors to ensure the timely execution of its projects with quality finishes.

“As we expand our footprint locally, our goal is to offer local and foreign investors high-yield property assets. Samana’s strategy aligns with Dubai’s continuously bullish outlook of the real estate industry. Samana Developers has a well-planned forward-looking growth strategy, innovative ideas, affordable and quality assets, which attract the local and international investors.” Farooq said.

Samana has long-term payment plans that offer up to eight years with one per cent monthly payment. It is aimed at helping the buyer make the decision on buying an apartment and moving from a rented flat to owning a home, the company said.

Dubai’s consecutive bullish outlook has created a lucrative environment for the real estate sector. According to the latest data from the Dubai Land Department, Dubai registered a record 1.6 million real estate transactions in 2023, valued at AED634 billion, marking an annual growth of 20 per cent in the value of deals and 36 per cent in the number of transactions.

.jpg)