Jordan … The Gulf region is ahead of the game globally.

Jordan … The Gulf region is ahead of the game globally.

COP28 is here. The 28th round of the United Nations Climate Change Conference is being held at the Expo City in Dubai until December 12.

Some commentators outside of the Gulf region have raised an eyebrow at the idea of a globally-prestigious climate change conference being held in the UAE. This surprise is, of course, rooted in the view that the Gulf region is only about oil and gas. As such, the region represents the old carbon-heavy energy industries that have sustained it for decades. In the commentators’ view, there will be a lot of talking about initiatives to combat climate change but this region cannot genuinely promote the Energy Transition if it will conflict with the region’s long-standing interests.

Those commentators are wrong. The Gulf region is ahead of the game globally.

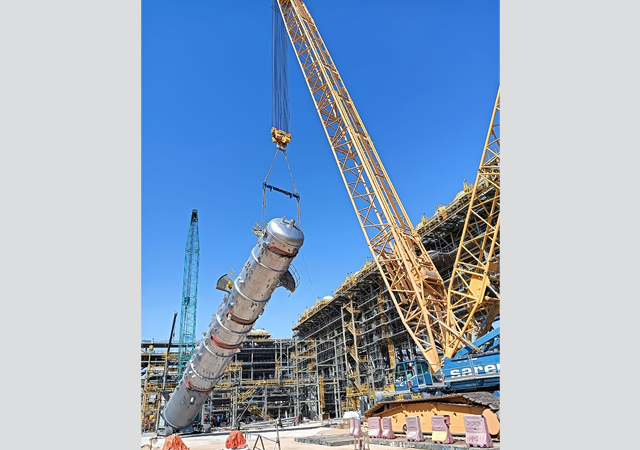

Along with many of my colleagues at Baker Botts, I have been living the Energy Transition for over three years, working on the Neom Green Hydrogen Project. This is the world’s largest green hydrogen production facility currently under construction at Oxagon, in Neom, on Saudi Arabia’s northwestern coast. Here are some figures:

• The power source is around 4 GW of wind and solar power;

• From the start of commercial operation in 2026, it will produce 600 tonnes per day (240,000 tonnes per year) of green hydrogen, to be converted into ammonia, for transport by ship to markets globally;

• The total investment value is $8.4 billion;

• Financing is on a non-recourse basis and involves 23 banks and investment firms. Financial close was achieved in May this year.

These figures don’t do justice to the project. It isn’t just “bigger than the rest”; it is the world’s first industrial-scale green hydrogen project. This project involves the deployment of new and fast-developing technologies; and the integration of those technologies at scale for the first time.

The project owner (Neom Green Hydrogen Co) is an equal joint venture between Air Products and Chemicals Inc, Acwa Power and Neom Company. Air Products, additionally, took on the role of engineering, procurement and construction (EPC) contractor for the whole project and is the exclusive 30-year offtaker of the entire green ammonia product. My firm was instructed by Air Products on several aspects, most importantly, the EPC and offtake contracts.

The scale and technical novelty in this project were reflected in the challenges for us, and for the Air Products legal and technical teams, in putting together the engineering, procurement and construction contracts. In truth, there was one huge underlying challenge that manifested in many ways: that is the melding together of two completely different sectors (renewable power and process engineering) into one operational plant, delivered under a single EPC contract.

Market-standard contract terms in these two sectors reflect their technical differences, particularly in mechanical completion, performance testing, rework (plant optimisation) and acceptance. So, the integration of a wide range of subcontracts and supply contracts to support the main EPC, was the largest single part of our work.

There were positive factors that helped to counter these challenges: the joint venture (JV) sponsors were committed to making it happen, and the lenders were equally keen to be part of this first-of-a-kind project. And the willingness of Air Products (the world’s biggest industrial gases producer) to deliver the project as single-source EPC contractor, was key to success in closing this project.

This project has given a cue to the energy industries. It is already the centre of attention from other would-be developers of green hydrogen projects globally. There are planned projects all over the Middle East. S&P Global counts 83 “clean hydrogen” (low carbon or renewables-based hydrogen/ammonia) projects in the region, with capacity on completion at 9 million tonnes of hydrogen per year. That is up from 37 projects and projected capacity of 4.2 million tonnes per year, as counted in October 2022. Nine of these projects have reached FID (final investment decision).

Of course, green hydrogen production is going to be a global activity, as will consumption of it. The race to develop production will run in parallel with the race to win market share for the product – which will depend partly on regulation. The US is finalising its incentives regime and the major markets globally are starting to set out their own rules on recognising “green” fuels. Not much of this is settled yet but the pace of development, particularly in the US, is extraordinary. So, there will be several major production centres, but undeniably the Gulf region has been a first mover.

With all the talk about the Energy Transition, projects like Neom Green Hydrogen, and the others to follow it, show that this region is also walking the walk.

It is ironic that governments around the world like to say that they are going to be “the Saudi Arabia of renewables”. Right now, the Saudi Arabia of renewables is…Saudi Arabia!

* Stuart Jordan is a partner in the Global Projects group of Baker Botts, a leading international law firm. Jordan’s practice focuses on the oil, gas, power, transport, petrochemical, nuclear and construction industries. He has extensive experience in the Middle East, Russia and UK.

.jpg)

.jpg)

.jpg)