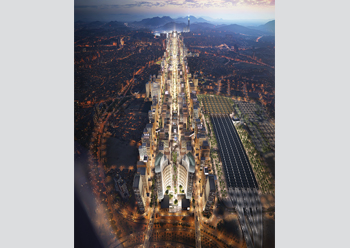

An artist’s impression of The Red Sea Airport.

An artist’s impression of The Red Sea Airport.

Saudi Arabia has been grabbing global attention over the past couple of years with the launch of its giga-projects, many of which have begun translating into reality, giving a new thrust to the kingdom’s 2030 Vision’s ambition to draw big-ticket investors to its shores.

Indeed, according to Saudi Arabia’s HRH Crown Prince Mohammed bin Salman, the kingdom intends to spend more in the next 10 years than it has done in the past 300 years – this in partnership with the private sector.

“If we take total spending to SR27 trillion ($10 trillion) over the next 10 years, it means that Saudi Arabia will spend more than it has done in the past 300 years. That’s huge!” he said.

.jpg) |

|

Riyadh Metro ... expected to be flagged off this year. |

Prince Mohammed was speaking in late March as he launched the “Shareek” or ‘partner’ programme between the private and public sectors, with new investments amounting to SR12 trillion. The Crown Prince explained that this does not include the government spending estimated at SR10 trillion during the coming 10 years, and private consumption spending expected to reach SR5 trillion until 2030, bringing the total spending to SR27 trillion over this decade.

He reiterated this message in a wide-ranging television interview late last month, where he emphasised the pivotal role being played by the Saudi sovereign wealth fund Public Investment Fund (PIF) in a concerted drive to attract billions of dollars of private investment for the kingdom’s development ambitions. During the interview, he also highlighted the new PIF affiliate Roshn’s mandate to provide around one million housing units in line with the Saudi Vision 2030’s target to ensure that 70 per cent of Saudi citizens owned their own homes.

Key government development funds will also be spearheading efforts in their specific fields such as the National Development Fund, the Real Estate Development Fund, the Tourism Development Fund, the Cultural Development Fund, and other funds, which will pump an estimated SR1 trillion annually, according to the budget each year.

The Crown Prince said that the kingdom would witness a giant leap in investments over the coming years, of which SR3 trillion will be pumped by the Public Investment Fund until 2030, as announced at the beginning of this year.

.jpg) |

|

Massive redevelopment is under way as part of the Masar project for Makkah. |

In late March, Prince Mohammed also announced two path-breaking environmental initiatives – The Saudi Green Initiative and The Middle East Green Initiative – that aim to set a clear “green” road map for the kingdom and rallies the region in significantly confronting climate change. The Saudi Green Initiative will work to reduce carbon emissions by more than four per cent of global contributions, through an ambitious renewable energy programme that will generate 50 per cent of the kingdom’s electricity from renewables by 2030, and several other projects in the fields of clean hydrocarbon technologies while raising the rate of waste diversion from landfills to reach 94 per cent in the kingdom.

All these investments mean megabucks will need to be spent on infrastructure to create the factories, offices, hotels and resorts, airports, power and desalination facilities, homes, logistic facilities and other ancillary services that will be required to transform vast, largely virgin remote areas into tourist destinations, industrial or commercial hubs as the plans may be.

Saudi Arabia’s vision to diversify its economy by exploring its tourism potential and create ambitious destinations is already seeing the rise of the $500-billion futuristic city of Neom in the northwest of the kingdom, as well as the Red Sea Project and Amaala along the Red Sea coast, which will capitalise on the area’s vast, pristine island and coastal beauty; AlUla and the $17-billion Diriyah Gate, which centre around Saudi Arabia’s Unesco World Heritage sites; the $10-billion Qiddiyah Project, being built from scratch on a 334-sq-km area in the southwest of Riyadh, which will offer a multi-dimensional entertainment hub; the $3-billion Asir mountain hub; and Spark, which is creating a global energy hub in the Eastern Province.

|

|

Qiddiya ... a mega entertainment hub taking shape near Riyadh. |

Also launched last year was a SR3-trillion plan to double the size of capital Riyadh in the next decade and transform it into an economic, social and cultural hub for the region. The plan involves the creation of a mega industrial zone focusing on advanced technology such as renewables and automation, and biotechnology and aquaponics. Another key feature is sustainability, with energy conservation, the circular carbon economy with its emphasis on reducing emissions, and water management, which are all priorities according to a senior government official.

“You will see seven million trees planted in Riyadh in the next few years, and King Salman Park will be bigger than Hyde Park in London,” remarked Fahd Al Rasheed, President of the Royal Commission for the City of Riyadh, while unveiling the ambitious strategy for the Saudi capital.

“Riyadh is a very important economic engine for the kingdom, and although it’s already very successful, the plan now, under Vision 2030, is to actually take that way further, to double the population to 15 million people,” he stated.

According to him, around $250 billion in investment is expected from the private sector, with the same amount generated by increased economic activity from population growth, finance and banking, cultural and desert tourism, and leisure events.

He stated that Royal Commission had already launched 18 megaprojects in the city, worth over SR1 trillion to both improve liveability and deliver much higher economic growth to create jobs and double the population in 10 years. Among the mega projects for which Riyadh is seeking investment are the King Salman Park, Sports Boulevard, Riyadh Art and Green Riyadh. According to Al Rasheed, Riyadh is also aiming to become a Middle East artistic and cultural hub, with plans to build an opera house.

Among the most ambitious projects of the Royal Commission for the City of Riyadh is the $27-billion Riyadh Metro and Bus project, which is expected to flag off later this year.

Jeddah, meanwhile, is set to host the inaugural Saudi Formula One race on November 28, 2021 – news which brought cheer to the real estate and hospitality sector, apart from sport enthusiasts. The foundation stone for the track - which essentially will be staged on the city’s streets along Jeddah Corniche – was laid last month. There are plans for the Saudi Arabian Grand Prix to move eventually to Qiddiya, about an hour’s drive from the capital Riyadh, once a permanent circuit has been built.

Another key development late last year was the setting up of the Tourism Development Fund with SR160 billion funding signed with two banks to develop major tourism projects across the kingdom, according to SPA.

With religious tourism having traditionally been its source of income in the tourism sector, obviously Saudi Arabia continues to spearhead developments in the holy sites of Makkah and Madinah. Early this year, Saudi Arabia announced the launch of a new company, Kidana, with an authorised capital of SR1 billion, which will be responsible for the development of the holy sites. Among the key projects under way in Makkah is Masar, which involves setting up a mega urban corridor (see Page 60).

Despite the Covid-19 pandemic that continues to rage unrelentingly around the globe, most of Saudi Arabia’s mega projects have been making progress. In addition, the kingdom accounted for some 54 per cent of the new projects, amounting to $19 billion, announced in the GCC in the first quarter of this year, according to a report by BNC (see Page 6).

HOUSING

In order to achieve a key objective of the kingdom’s Vision 2030 that aims to ensure that 70 per cent of its citizens own their homes, Saudi Arabia continues to construct housing units at an impressive pace. The Public Investment Fund’s recent establishment of Roshn, one of the largest national master developers, is expected to attract more private sector involvement while reducing the burden on government resources to allocate housing to citizens.

The real estate developer’s first community is Roshn Riyadh, which is coming up on a 20-million-sq-m area near King Khalid International Airport and will eventually feature over 30,000 homes. It has already signed partnerships with a number of companies to develop the community. Roshn is planning to start off-plan sales at its flagship project later this year, with the handover of the first homes likely in early 2022.

Roshn’s Riyadh Community forms part of the developer’s wider 10-year strategy to contribute to the rapidly increasing demand for housing across the kingdom.

RAIL & METRO

Work on what is described as the world’s largest single-phase metro construction project is nearing completion in Riyadh with operations due to commence by the end of this year.

The Riyadh Metro and Bus project was originally conceptualised for development over 25 years. The Riyadh Metro network consists of six lines with a length of 176 km. It also comprises 85 main and secondary stations and seven depots and maintenance centres. The Riyadh Bus network features 24 lines extending over 1,900 km.

Meanwhile, work is under way on the $7-billion Saudi Landbridge Project, which involves construction of a 950-km new line between Riyadh and Jeddah and another 115-km track between Dammam and Jubail.

The project that links the seaports on the Red Sea coast to those on the coast of the Arabian Gulf via Riyadh, is being development by Saudi Railways Company (SAR).

AIRPORT & PORTS

Airports are being built in the new destinations taking shape in Saudi Arabia, including at The Red Sea Project, while existing ones are being upgraded.

A masterplan is being readied to create a new urban district adjacent to King Abdulaziz International Airport in Jeddah. There is also a multibillion-dollar expansion plan for Riyadh’s airport, but this is reported to have been put on hold as the kingdom re-assesses priorities in light of the coronavirus impact.

In the ports sector, Saudi Ports Authority (Mawani) has signed a 30-year-long build-operate-and-transfer (BOT) contract to develop the northern part of Jeddah Islamic Port, making it the largest container terminal in the kingdom, with investments worth SR6.6 billion.

In cooperation with the National Privatization Center and the Ministry of Transport, Mawani also aims to award 12 such BOT contracts to the private sector, the Saudi Gazette reported Mawani President Engineer Saad Alkhalb as saying.

WATER & WASTEWATER

Saudi Arabia has launched what is said to be the largest public-private partnership (PPP) desalinated water procurement programme in the world.

Steering this programme is the Saline Water Conversion Corporation (SWCC) and its associate Saudi Water Partnership Company (SWPC), which are pressing head with a number of seawater desalination plant projects in the kingdom including Jubail-3A, Jubail-II, Shuqaiq 1 and Shuqaiq 3 and Al Khobar RO2 plant.

SWCC recently marked completion of seven small and medium-sized plants including the Al Khobar I desalination plant.

Another area where Saudi Arabia has joined hands with the private sector is in sewage treatment, with a number of independent sewage treatment plants (ISTP) being set up in various parts of the kingdom. The National Water Company (NWC) is looking at private sector participation in 114 sewage treatment plants with a total daily capacity of 5.1 million cu m per day and has launched the first phase of the programme which covers 15 sewage treatment plants with a total capacity of 2.5 million cu m/day.

EDUCATION

The education sector too is in the midst of privatisation. Aecom, a premier infrastructure consulting firm, early this year announced the start of Wave 1 of the Schools Infrastructure Development PPP.

The project, which will see a roll-out of up to 4,000 schools, is aimed at expanding the country’s educational infrastructure and readying for significant future demand.

Aecom is the technical advisor lead for Tatweer Buildings Company, a subsidiary of the PIF, which is tasked with facilitating the funding, construction, supervision, management, operations and maintenance of new schools in the kingdom on behalf of the Ministry of Education, in the region’s first such PPP. Comprising 27 new schools to be built in Jeddah and 33 schools in Makkah, the design and construction phase for Wave 1 will eventually provide schooling for 50,000 pupils.

The PPP’s ‘Build Maintain Transfer’ model will be applied across all three Waves with the first of the schools opening in Jeddah in August next year.

Hill International, the global leader in managing construction risk, has secured a key contract to provide facilities management (FM) consultancy services for Tatweer Building Company. The contract involves three main projects: two headquarters buildings in the Saudi capital; Riyadh Schools and associated administrative buildings, which consist of more than 2,000 facilities; and Eastern Province schools plus administrative buildings totalling another 2,000 facilities.

The current portfolio has more than 6,000 sites and TBC is scaling up its operations to accommodate the complete portfolio as part of the Ministry of Education’s goal of transforming the current educational system.

MEGA PROJECTS UPDATE

Neom: The $500-billion Neom development early this year launched The Line, which is described as a revolution in urban living. The Line is a 170-km belt of hyper-connected future communities, with a focus on walkability (see Page 43). Aecom has been appointed to design transport and utilities backbone infrastructure for the futuristic city.

The Red Sea Project: Saudi-based Red Sea Development Company (TRSDC), the developer behind the world’s most ambitious regenerative tourism project, has awarded a significant number of contracts over the past year, fast-tracking work on Saudi Arabia’s flagship international tourism destination (see Page 46).

Among the latest, it has signed up Contracting and Construction Enterprises (CCE) to design-and build infrastructure at its Coastal Village, a key component of the project (see also Digital Edition, Page 88). Early this year, TRSDC appointed Dubai-based Killa Design to design the overwater and inland villas on Sheybarah Island, another key part of The Red Sea Project.

Qiddiya: Saudi-based Qiddiya Investment Company (QIC), in partnership with Intamin Amusement Rides, has kicked off the design process for the Falcon’s Flight, the signature attraction of Six Flags Qiddiya, a one-of-a-kind theme park scheduled for opening in Qiddiya’s first phase.

The Falcon’s Flight is set to become the world’s longest, fastest and tallest coaster.

QIC has awarded construction contracts worth SR2 billion over the last 12 months since work began on its giant entertainment hub located near Riyadh.

Amaala: Tamimi Global Company (Tafga) is working on a design-and-build contract for the construction of the first stage of the Triple Bay Construction Village at Amaala. Excavation, backfilling, and earthworks is being undertaken by Hasan Al-Harbi Corporation (see Page 51).

AlUla: An ambitious plan to transform AlUla historical region into “the world’s largest living museum” was kick-started last month with the launch of a masterplan known as ‘The Journey Through Time’ by Saudi Arabia’s Crown Prince Mohammed bin Salman last month (see Page 63).

Diriyah Gate: This unique development centred around At-Turaif, the country’s Unesco World Heritage site, is taking shape in the Riyadh region. Diriyah Gate Development Authority (DGDA) expects to release contracts worth a total of SR16 billion this year to develop this destination (see Page 54).

Asir mountain hub: Soudah Development Company (SDC) has recently been established to develop a luxury mountain destination in the Asir region. SDC will inject $3 billion into infrastructure and tourism projects, aimed at enhancing the visitor experience in Soudah and parts of Rijal Alma’a Governorate in Asir. The planned developments include 2,700 hotel rooms, 1,300 residential units, and 30 commercial and entertainment attractions.

Spark: A global hub for the energy sector is fast taking shape over a massive 50-sq-km site in the Eastern Province, with the first phase of infrastructural development on the King Salman Energy Park due for completion this year. Given the demand it has witnessed from investors, Spark is said to have accelerated the second phase of infrastructural development (see Page 57).

.jpg)

(1).jpg)