The aviation sector in the Middle East is poised for greater growth and will continue to reinforce its travel hub status, given the fact that a majority of the region’s airports were kept open during the peak of the Covid-19 pandemic and the easing of visa restrictions, according to a top official of Hill International.

Saudi Arabia, in particular, intends to build 22 airports, he says, with the bulk of them being greenfield.

Commenting on the prospects for the region’s aviation sector, Hill International’s Middle East President Abdo Kardous says: “As a majority of the Middle Eastern nations kept their airports open during Covid offering the maximum possible flights, the Gulf in general became a hub between the East and the West due to the connectivity it provides to various destinations. Also, the visa-free entry requirements in the GCC has helped strengthen the region’s position as a hub for travel or transit/short vacations. Compared with the bottlenecks of travel in Europe’s major airports/hubs this summer, it was relatively smooth in the GCC. This will have a long-term impact for travellers to the GCC as they would have felt first-hand the relative ease of transiting/transferring through the region and avoid the congestion.”

In the region, the focus will continue to be on the UAE and Saudi Arabia.

|

|

Kardous ... GCC is not stopping to invest. |

The value of Saudi Arabia’s planned 22 airport developments is estimated to be a few hundreds of billions of dollars and such a build-up clearly will attract millions of travellers, he adds.

“The airport at Neom is planned to have a capacity of 50 million passengers per year. To put this in perspective, the Muscat International Airport has a capacity of 14 million passengers per year, Dubai is expected to handle 62.4 million passengers in 2022 and Hong Kong can handle about 75 million passengers per year,” Kardous remarks.

Apart from Saudi Arabia, other Gulf countries like Bahrain, Oman, Qatar and Kuwait are still going through enhancements. For the World Cup later this year, Qatar has completed one of the expansions, but work on concourses D and E is ongoing and will be finished after the event. In the UAE, there will be additional projects too that will add new capacity, according to the Hill International Middle East President.

In airport capacity terms, what the Gulf economies have built will serve them well for the next two decades or so but the GCC is not stopping to invest in its aviation infrastructure sector with projects stretching over the next decade, he opines.

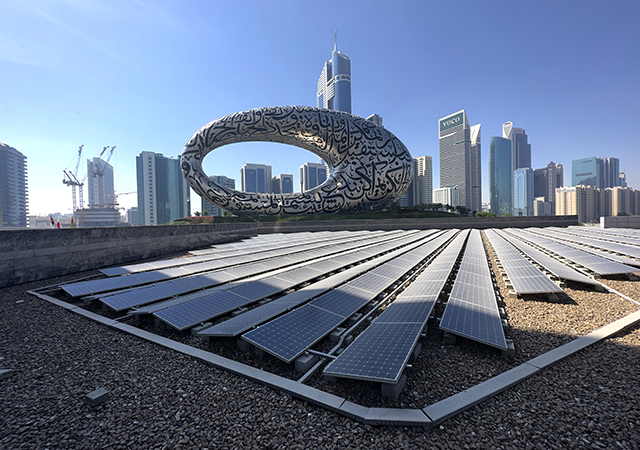

“At present, Abu Dhabi is operating with Terminal 3. But think of the new capacity that will be added when the 750,000-sq-ft Midfield Terminal is operational. Also, Dubai is operating between Terminals 1, 2 and 3 with two runways, while some flights are operating out of the Maktoum International Airport which plans to have six runways. The biggest development is planned in Saudi Arabia,” he says.

|

Muscat airport ... a major project handled by Hill International. |

Another country in the Middle East, Iraq, is now working on the Nasiriyah and the greenfield Al Anbar International Airport projects.

“In Egypt, plans are afoot to build Terminal 4 at the Cairo International Airport, besides the construction of new regional airports that will connect travellers directly with touristic destinations along the Nile River,” Waleed Abdel Fattah, Managing Director of Hill Africa, indicates.

Meanwhile, looking at prospects for the aviation sector across the globe, Kardous believes that Europe is nearly saturated and with the strong growing demand for shipping, high-speed rail and highways, there are alternative options to flying. The US aviation infrastructure sector is still awaiting key investments in the major projects.

“However, the growth will primarily be in India, China and Indonesia. India has said it will build at least 100 greenfield airports, while China was talking about 400 additional airports. Given its vast stretch of islands from east to west, Indonesia is another potential investment destination,” Kardous states.

Worldwide, travel has bounced back and several airports are operating close to the pre-Covid level, according to Kardous.

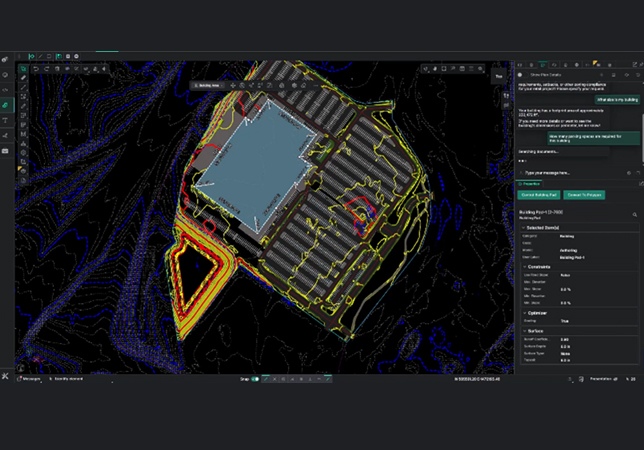

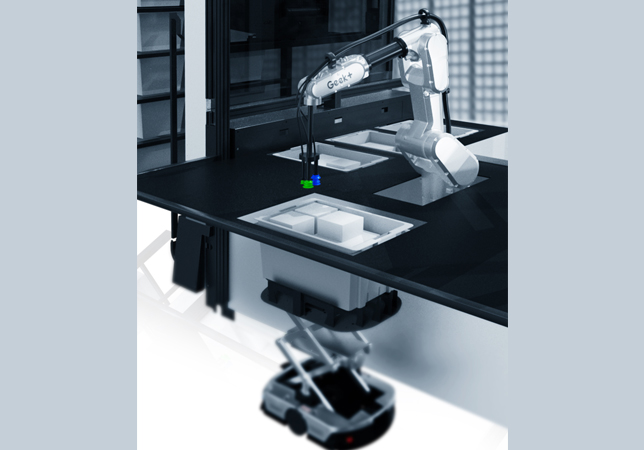

In order to be better placed to respond to pandemics such as Covid-19, airport construction and design has evolved, with airport operators having come up with several touchless processes for checking in and tagging of baggage.

“We will see more automation and less reliance on staff. More technology will be used that will reduce dependance on resources,” he concludes.

* Hill International has provided or is providing PM/CM services for airports in Bahrain, Hamad International Airport in Qatar, Abu Dhabi Midfield Terminal, Al Bateen (Abu Dhabi), and Muscat and Salalah in Oman.

.jpg)

.jpg)

.jpg)