Aldar in deal to sell Abu Dhabi Golf Club complex

Leading UAE developer Aldar Properties has agreed to sell the Abu Dhabi Golf Club complex, including the Westin Hotel and the Abu Dhabi Golf Course, to a financial investor for Dh180 million ($49 million).

The sale, which has a transaction value representing a 13 per cent increase on the entry price, is in line with Aldar’s asset management strategy to actively pursue profitable investment exits and redeploy capital into growth opportunities, said the developer.

The complex, which also includes land for development of residential property covering a 46,543-sq-m gross floor area, was acquired by Aldar as part of a wider transaction with Abu Dhabi’s Tourism Development Investment Company (TDIC) in 2018.

Chief Investment Officer Jassem Saleh Busaibe expressed delight at having successfully conducted the sale of this luxury hospitality complex, a testament to its team’s ability to create value through active management, despite challenges to the hospitality and tourism industry from Covid-19.

“We will continue to pursue opportunities for significant growth and further diversification of the Aldar Properties portfolio,” he stated.

The Westin Abu Dhabi Golf Resort and Spa is a luxury five-star hotel with 172 keys, and features six restaurants, 2,256 sq m of conference space, two swimming pools and a high-end spa. The hotel was built in 2011 and is currently operated by Marriot International under a management agreement.

The Abu Dhabi Golf Club features an 18-hole championship course and nine-hole garden course. It was inaugurated in 2000 and is home to the European Tour Abu Dhabi HSBC Championship since 2006. The golf club is currently under a licensed and technical service agreement with Troon International.

The complex also includes around 500 sq m for residential development.

Al Habtoor launches 537-unit luxury residential tower sale

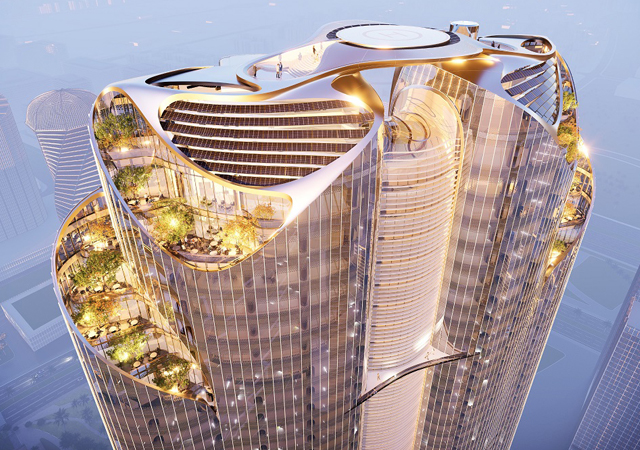

Al Habtoor Group has launched the sale of its 73-storey Amna Tower, the third and last property in the group’s Residence Collection.

Located at the Dubai Water Canal banks, the premium development boasts 537 luxury units, including four ultra-luxury penthouses.

In the heart of the one-million-sq-ft Habtoor City, The Residence Collection consists of three luxurious residential towers – Noora, Amna and Meera, with a total of 1,460 luxury apartments within the three high-rise buildings.

The high-end homes, which range from one- to seven-bedroom units, boast stunning views of Dubai’s skyline. Each bedroom features an en-suite bathroom. Residents also have access to the region’s largest resort-style pool deck, which spans more than 120,000 sq ft.

Khalaf Ahmad Al Habtoor, Founding Chairman, says: “I am pleased to report that during the pandemic, we have witnessed a healthy demand for real estate within our portfolio, from local and international investors alike.”

Al Habtoor says it is a unique project, thanks to its location, directly on The Dubai Water Canal and along Sheikh Zayed Road.

“It is an unrivalled lifestyle destination with exceptional facilities. Residents get the benefit of having three international hotels within Al Habtoor City. And enjoy La Perle the unforgettable aqua show,” he explains.

GFH boosts retail presence with key mall acquisition

GFH Financial Group (GFH), the leading investment group in the Middle East, has expanded its presence in Bahrain’s retail sector by acquiring 80 per cent of Hidd Mall alongside a strategic investor.

The 46,000-sq-m mall, located in the Hidd area of Muharraq, is fully leased to Lulu Hypermarkets, a major retail chain in the Middle East. The mall currently boasts 100 per cent occupancy, with Lulu Hypermarkets sub-leasing the space to a diverse range of multinational, regional and local tenants.

GFH currently has $12 billion assets and funds under management across a range of industries and sectors globally. In addition to Hidd Mall, the group’s retail investment include Events Mall in Jeddah and the Entertainer, a leader in loyalty and rewards solutions, it states.

On the deal, Chief Investment Management Head Hammad Younas says: “GFH is excited to announce this latest landmark acquisition, one that is underscored by having Lulu Hypermarkets, the strongest retail chain in the GCC, as the primary tenant.”

“This a resilient investment in a key sector which we believe will witness significant growth as the pandemic winds down. Malls anchored by grocery stores have already proved highly resilient, with families choosing to stay at home more during the pandemic,” he adds.

The new retail destination enjoys a high footfall from Hidd residents. In addition to the Lulu Hypermarket, Hidd Mall offers a range of banking, retail and food and beverage (F&B) outlets such as the National Bank of Bahrain, Khaleeji Commercial Bank, Standard Chartered, Malabar Gold and Diamonds, Yum Yum Tree Food Court, KFC, Baskin Robbins, Jasmi’s and Gloria Jean’s Coffees.

Other government and service providers located in the property include branches for the Bahrain Traffic Police Station and Ministry of Interior, alongside telecommunications providers Batelco and STC, says GFH.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Doka.jpg)