Jordan ... we should be open to ideas which cut down the room for disputes in quantifying damages.

Jordan ... we should be open to ideas which cut down the room for disputes in quantifying damages.

The new Fidic Green Book includes provisions for the payment of liquidated damages to the contractor when delay is caused by an employer risk event, to cover for his prolongation costs.

This is not a common use of liquidated damages but the advantages in any agreement to pre-fix damages are obvious. We are prioritising certainty and convenience over accuracy. We have decided that the time, trouble and uncertainty of trying to assess the actual damages is not worth the benefit of identifying an accurate amount.

So our question for today is: how far can we usefully extend that benefit of certainty and convenience to quantifying liabilities beyond the usual metrics of contractor delay and plant underperformance?

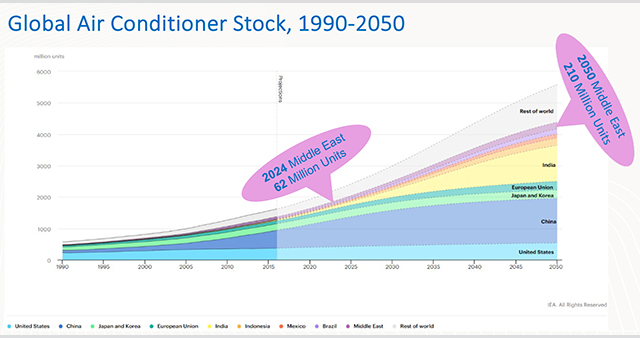

One extension, common in the Middle East, is the requirement to pay liquidated damages for delayed works milestones as well as for delayed handover of the whole works. That might be problematic in English Law contracts because there are no obvious losses to the owner from interim delays when the works might, in fact, be handed over on time. This is thought to be potentially unenforceable as a penalty, although the motivation behind such provisions is said to be to keep contractors on track and to avoid small early delays snowballing. It would be interesting to see whether this might actually pass the new broader English Law enforceability test, as a genuine measure to protect the owner’s legitimate commercial interests.

Another common extension is “stipulated damages” which are fixed sums agreed to be paid for specific breaches. When these damages are applied to the quality of finished works (sums payable on measured deviation from specified levels, compaction, rigidity, etc), they are not really different from performance liquidated damages. When they are applied to procedural metrics (Key Performance Indicators) such as health and safety incidents or turnover of key personnel, stipulated damages are more obviously “motivational” rather than compensatory and, therefore, potentially penal. Interestingly, these is no controversy when KPIs are backed up by bonuses rather than stipulated damages – but there is no difference between paying those damages and losing a bonus!

More commonly these days also we see pre-agreed sums payable from termination. Following termination for convenience or for owner default, the contractor might be entitled to a proportion of the value of the work not carried out, to compensate for profit not earned. On the reverse side, parties might pre-agree the contractor’s liability for the additional cost of completing the works with new contractors following termination for contractor default. This also brings the benefit of a quicker resolution to that liability, rather than the parties having to wait until final accounting on the completed project.

The idea of “reverse liquidated damages” has been around for some time and is more common in US contracts, as far as I have seen. It is now also a feature of the new Fidic Green Book (2021) just launched. This is Fidic’s short form of contract, intended for use in lower value and low risk projects. It is not a feature of the bigger main contracts (Red, Silver and Yellow Books) but we should see if it would be useful generally.

It goes like this: where delayed completion is caused by an owner (Employer) risk event, the contractor’s entitlement to prolongation costs is (exclusively) determined by a formula using weighted values for onsite and offsite costs including overheads. This calculation results in a daily rate of damages payable to the contractor. There are a couple of interesting points:

First, the rate of prolongation damages is based on both the time when the delay event occurred and the value of works carried out (as valued by the Engineer) at that time.

Second, this calculation only covers prolongation costs. The “hard costs” of disruption to works causing decreased efficiency, are not recoverable automatically from the delay: they are still to be claimed, evidenced and quantified in the normal ways.

It has been commented that the formula is complicated – certainly it is not as simple as a daily rate for delayed completion. In my view, there is nothing wrong with trying to achieve some reflection of reality in the calculation of liquidated damages. The situation we are trying to avoid is the time, trouble and uncertainty of quantifying actual damages – bringing the increased likelihood of claims turning into disputes. So long as the inputs to the calculation are accessible, transparent and not open to argument, this goal is achieved.

Equally I can see why Fidic did not attempt to pre-determine true disruption costs. The variables (and the potential sums involved) are greater than with prolongation, and are not closely tied (or maybe not tied at all) to delayed completion.

In short, we should be open to ideas which cut down the room for disputes in quantifying damages – but there are limits to this, and I think the new Green Book recognises them.

* Stuart Jordan is a partner in the Global Projects group of Baker Botts, a leading international law firm. Jordan’s practice focuses on the oil, gas, power, transport, petrochemical, nuclear and construction industries. He has extensive experience in the Middle East, Russia and the UK.

_0001.jpg)

.jpg)

.jpg)

.jpg)