Bahrain Bay ... a key area that is witnessing major real estate development.

Bahrain Bay ... a key area that is witnessing major real estate development.

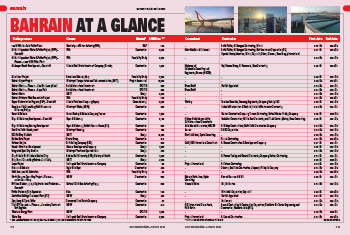

With the promise of increased revenues as Bapco refinery ramps up production later this year following its upgrade and a robust $30-billion infrastructure project pipeline, Bahrain is pushing ahead on its path to post-Covid recovery. The nation has also charted out its course of action with a far-reaching Economic Recovery Plan and appointed a new Cabinet to spearhead growth as well as tackle the challenges of a widely anticipated global recession.

A Fitch Ratings report indicated that Bahrain’s real GDP growth would reach above six per cent in 2022, buoyed by very strong non-oil growth as tourism-related sectors and real estate and construction posted strong performances.

In fact, tourism, followed by infrastructural and industrial development, will be the prime drivers for growth in the construction sector this year as Bahrain actively seeks the support of the private sector and foreign investment to push its ambitions forward.

With the recent opening of a world-class international airport terminal and a state-of-the-art exhibition and conference centre, Bahrain has put in place two essential ingredients to spearhead its growth in the tourism and MICE sectors. Plans are also being mulled for a greenfield airport in the long term.

Next on the list of priorities in line with its latest tourism strategy (2022-26) is the development of new tourism zones and facilities. An important hub that is fast taking shape is in Sakhir around the Bahrain International Circuit, which has recently seen the inauguration of Exhibition World Bahrain (see Page 15), following the completion of Al Dana Amphitheatre in late 2021 – with a showpiece Sports City also earmarked for the area.

|

|

Bahrain’s first U-turn flyover ... newly opened as part of the Al Fateh Highway upgrade. |

Another such zone, Bilaj Al Jazayer, is being master-developed by Bahrain Real Estate Investment Company (Edamah) – the real estate arm of Bahrain Mumtalakat Holding Company (Mumtalakat) – on the southwest coast of the kingdom, which will boast outstanding beach and hospitality facilities.

However, pivotal in its long-term plans for the tourism sector will be the much-awaited Bahrain Metro project, which will boost mobility in key areas of the country over its four phases. The estimated $2-billion metro project will go a long way in easing the traffic situation in Bahrain. The kingdom is already exerting efforts to relieve congestion on its roads with major developments such as the Al Fateh Highway upgrade.

Apart from tourism, another key sector prioritised in Bahrain’s Economic Recovery Plan, is industry. Industry and tourism together are targeted to contribute as much as 26 per cent of the country’s GDP by 2026.

In the industrial sector, Aluminium Bahrain (Alba) – the world’s largest aluminium smelter ex-China – is a key enabler for a thriving downstream sector. Last year, the industrial giant signed a memorandum of understanding (MoU) with Emirates Global Aluminium (EGA) with a view to raising output at its Potline 6 to beyond its name-plate capacity as well as utilise EGA technology in future expansions at its smelter. Through this partnership, Alba is eyeing a potential brownfield expansion with Potline 7. Bechtel has been appointed to conduct a feasibility study for the Line 7 project. The smelter recently flagged off work on a fourth block at the Power Station 5 which will add 680 MW, scaling up its total capacity to 2,480 MW.

Another strategic project is the ambitious $6-billion Bapco Modernisation Programme (BMP), work on which is expected to be completed in 2023. This major expansion and upgrade will boost the refinery’s capacity by 42 per cent, from the existing 267,000 barrels per day (bpd) to 380,000 bpd.

|

|

Marassi Al Bahrain ... key residential buildings taking shape. |

In line with Bahrain’s industrial growth strategy, a number of major industrial parks and zones such as the US Trade Zone are being developed, which will provide key opportunities for the contractors in the country.

In the logistics sector, following the recent completion of work on Bahrain International Airport (BIA), Bahrain Airport Company has laid the foundation stone for the Express Cargo Village on a 25,000-sq-m area within the BIA. This sophisticated logistics hub will provide a one-stop shop for express cargo operators, each of which will have its own premises within the facility.

Bahrain has an $30-billion infrastructure projects pipeline to support growth in a number of sectors including industry, logistics and tourism and to push ahead with this, the kingdom has embarked on a drive to bring the private sector on board, according to the global research and advisory firm Oxford Business Group (OBG).

GDP from construction in Bahrain reached an all-time high of BD240.49 million ($634 million) in the second quarter of 2022 and was expected to be BD246.12 million in the last quarter, according to Trading Economics global macro models and analysts expectations. In the long term, the Bahrain’s GDP from construction is projected to trend around BD253.51 million in 2023 and BD259.84 million in 2024, according to the US-based economic official data aggregator’s econometric models.

Meanwhile, Bahrain’s housing plans are moving ahead with thousands of homes and housing plots currently being readied in Khalifa Town, Salman Town, East Hidd and East Sitra Town. In November, the country announced further plans to construct 19,000 housing units worth BD1 billion across the kingdom over the next 10 years.

Metro

Construction tenders are expected to be floated shortly for the ambitious 109-km long Bahrain Metro project, which will be developed in four phases as an integrated public-private partnership (PPP) project.

The first phase will comprise an elevated corridor with two lines extending a total length of 29 km and 20 stations from Bahrain International Airport to Seef, linking both to Manama and the Diplomatic Area.

The overall project will comprise four lines. The project will have an initial capacity of approximately 5,000 passengers per hour per direction (PPHPD) with the scope for scalability and expandability to 23,000 PPHPD for each line.

Roads & Bridges

Among the most prominent road projects making impressive headway in the country is the upgrade of the Al Fateh Highway, which late last month marked the completion of its first phase with the inauguration of the country’s first U-turn flyover.

The project will enhance the capacity of this important arterial road by 61 per cent at a cost of BD40.5 million (see Page 33).

The project, which extends from the entrance to the Exhibitions Avenue to Mina Salman interchange, will increase the highway’s capacity from 87,000 to 140,000 vehicles per day once it is completed in 2024.

Another major project on the anvil is the $45-million Jasrah Interchange Upgrade which involves providing a 466-m-long left-turn flyover from Janabiya Highway to Sheikh Isa Bin Salman Highway. The project is slated for completion in the first quarter of 2025.

Power & Water

Among the most significant developments in the power and water sector was the launch of operation at Al Dur II Independent Water and Power project, which has a capacity to generate 1,500 MW of power based on combined cycle gas turbine technology and produce 227,000 cu m per day of desalinated water.

In line with global efforts, Bahrain is pushing towards renewables, with the Electricity and Water Authority (EWA) having recently launched two tenders that would involve development of solar projects. In September, the EWA launched the tendering process to appoint a qualified contractor to remediate a 2-sq-km landfill site in Askar to prepare the plot for the development and implementation of a solar project with a minimum capacity of 100 MW.

A month earlier, the EWA had issued tenders for a 20-year contract to harness solar power for a number of facilities in Sakhir. The tender aims to select a developer to build, own, operate and maintain grid-tied solar photovoltaic (PV) system with a minimum capacity of 72 MWac for the Bahrain International Circuit, University of Bahrain, Exhibition World Bahrain and Al Dana Amphitheatre.

Among others leading this change is Imerys, a world leader in mineral-based specialty solutions for industries, which has joined hands with sustainable solutions provider Yellow Door Energy to install over 8,500 solar panels at its white-fused alumina production plant in Hidd. The alumina plant is being jointly operated by Imerys and Bahraini partner Al Zayani Industries.

|

|

The National Assembly Complex ... designed by Bahrain-based Gulf House Engineering. |

National Assembly complex

The foundation stone for Bahrain’s National Assembly building was laid last month on behalf of HM King Hamad bin Isa Al Khalifa, by the Deputy King, HRH Prince Salman bin Hamad Al Khalifa.

The National Assembly building will cover 19,000 sq m. The first phase of the project will see the construction of the National Council hall that can accommodate 500 people, a hall for the Shura and Representatives Councils to host 40 people, and a multi-purpose hall. The project also includes a service building and facilities, a library, a museum documenting Bahrain’s democratic governance, a media centre, and an outdoor area surrounded by a gallery for opening ceremonies.

Real Estate

Bahrain’s real estate sector received a shot in the arm early last year with the announcement of long-term visas for non-Bahrainis as part of the kingdom’s Economic Recovery Plan to boost investment and attract global talent.

The 10-year Golden Residency Visa – open to residents, retirees, property owners and talented individuals in various fields – will, undoubtedly, create demand for residential and commercial space as these expatriates seek a more permanent living and working environment.

|

|

Bilaj Al Jazayer ... to host the Awani and Tivoli hotels. |

Bahrain’s real estate market is building back to pre-pandemic growth levels, with new figures showing a rise of 10.1 per cent in the volume of real estate trading until September last year over the same period in 2021, according to the Survey and Land Registration Bureau (SLRB). The bureau stated that the volume of real estate trading until the end of September 2022 amounted to about BD801,343,191.

According the CBRE’s latest real estate report for Q3, Bahrain’s real estate transaction volumes and economic growth projections continue to improve despite the global challenges. Real estate transactions in August totalled 2,431, making it the second most successful month since 2018 – transactions in Q3 reached a total of 5,482, it stated.

According to residential and commercial property consultancy Knight Frank, all sectors in Bahrain’s real estate market grew in the third quarter of 2022, with government initiatives and an improving economic outlook providing the impetus.

The kingdom also unveiled the Government Land Investment Platform, under which investment is sought to develop government-owned land – covering more than 230,000 sq m – and provide the required services. Currently, 17 projects are available, offering investors an opportunity to partner with Edamah (see Tenders, Page 63).

Seven are owned by the Ministry of Works, three are owned by the Ministry of Finance and National Economy, while the remaining seven are owned by Edamah.

Among the many projects being spearheaded by Edamah is the 1.3-million-sq-m ‘Bilaj Al Jazayer’, a mega mixed-use project on the southwest coast of Bahrain. Bilaj Al Jazayer includes a 3-km beach, which was reopened to the public in November 2021 as part of the project’s first phase. The development will include the Avani and Tivoli hotels, the first hospitality projects at Bilaj Al Jazayer, which are slated to open in 2024.

In the retail sector, the country’s showpiece mall The Avenues – Bahrain at Bahrain Bay has embarked on its Phase Two expansion, with the award of the construction contract to Nass Group.

The expansion project will extend The Avenues – Bahrain further along the west of Manama’s seafront, providing an additional 41,200 sq m of leasable space, which will include 244 units, two entertainment areas, an ice rink, and a supermarket, bringing the total leasable area to approximately 80,000 sq m.

The overall project includes the recently opened Hilton Garden Inn – Bahrain Bay hotel which is connected directly to The Avenues – Bahrain.

Also at Bahrain Bay, Kooheji Development, one of Bahrain’s leading real estate companies, has launched its new mixed-use project Onyx SkyView – its second after the Onyx, work on which is nearly complete. Spanning an area of 100,000 sq m, the tower boasts 435 ultra-luxury residences, 40 offices, and seven retail units at a prime location, opposite the iconic Four Seasons Hotel Bahrain. Construction works, which are due to commence this month, are slated to complete in December 2027 (see Page 21).

Another landmark development at Bahrain Bay is the Golden Gate Towers, work on which is expected to restart when its new owner the Bahrain-based developer Grnata Group announces a new contractor. The project was initially proposed to be the tallest residential structure in the kingdom (see Page 51).

Meanwhile, leading luxury hospitality company Four Seasons and Bahrain-based real estate development firm Bayside Developments have announced plans to develop the Four Seasons Private Residences Bahrain Bay, a collection of 112 bespoke homes offering access to the neighbouring Four Seasons Hotel Bahrain Bay with resort-style amenities, multiple restaurants, and a pristine beach.

In the residential sphere, Diyar Al Muharraq, the largest real estate development company in Bahrain, has reported significant progress within its eponymous master-development off Muharraq island.

Over the past year, the Bahraini developer has continued to launch new communities and infrastructure developments within the project. It has unveiled new model designs for its Aseel El Nasayem and Layl El Nasayem villas coming up within Al Naseem and is focusing on developing Southern Island where the main and secondary infrastructure works are now more than 90 per cent complete.

Diyar Al Muharraq has also marked the completion of the connection of the integrated city to the sewage treatment plant in Muharraq as well as of all infrastructure works within Phase Four of its freehold residential project, Al Bareh; and the secondary infrastructure works at Mozoon, which offers residential plots overlooking the city’s main water canal. Work is now under way on the community centre at the Jeewan neighbourhood, which is scheduled to be completed in the first quarter of 2023.

Meanwhile, at Marassi Al Bahrain – a key development being developed by a joint venture of Abu Dhabi-based Eagle Hills and Diyar Al Muharraq – construction work is under way on at least three 10-storey luxury apartment buildings. These include the Address Residences Marassi Vista, offering 200 luxury units, which is scheduled to be completed in the second quarter of 2024, Marassi Park set to be ready in Q3, 2023, and the 350-unit Marassi Terraces.

Upon completion in the first quarter of 2024, the mall’s promenade will extend a further 600 m to the west along the waters of Bahrain Bay, making The Avenues – Bahrain the largest waterfront shopping and entertainment destination in the kingdom, with a total length of 1.3 km.

_0001.jpg)

.jpg)

.jpg)

.jpg)

.jpg)